UVXY And VIX ETF Assets Surging Among Election Uncertainties (NYSEARCA:UVXY)

November 3rd is over and the U.S. presidential race continues. With an unprecedented turnout across the country in absentee voting and in-person voting, Americans have voiced their opinions. However, the fear that most of the country was concerned about is, indeed, coming true. An election result that the world was awaiting will continue to drag on with court battles and more litigation to come. With much geopolitical risk being discussed, traders and investors are taking notice buying hedging strategies that involve VIX related ETNs.

Election Results and The VIX Hovering Around 30

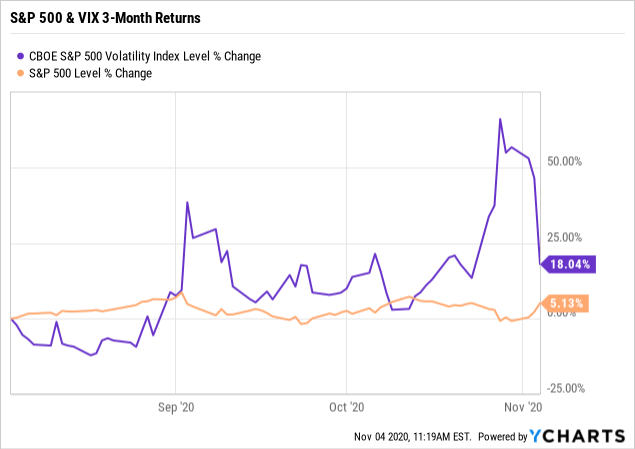

Recently, I have been writing more articles focused on the VIX, as the CBOE (CBOE) proprietary indicator has a way of indicating what short-term gyrations and volatility will do in the U.S. The VIX is calculated and shared on a real-time basis by the CBOE, and is often referred to as the market’s fear gauge or fear index. To summarize, the VIX is a volatility index derived from S&P 500 options for the 30 days following the measurement date, with the price of each option representing the market’s expectation of 30-day forward-looking volatility. Currently, investors are bidding up the VIX, even as markets continue to climb the wall of worry:

As of writing, the Dow Jones Industrial (DIA) is rising more than 700 points, and the Nasdaq (QQQ) up 4%. How in the world can the fear gauge be up more than 18.04%, but the overall markets are surging ahead? The answer lies in the products causing a higher VIX.

VIX Short-Term Futures ETNs and Growing Assets Under Management

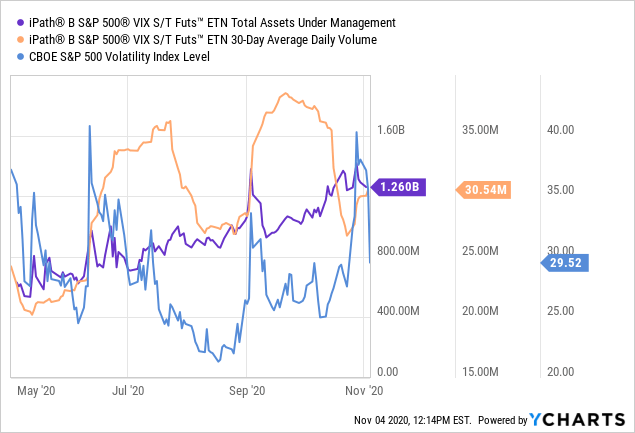

After doing some due diligence, I researched how the VIX could be elevated after such moves in risk assets and came up with one answer. Volatility based ETNs. According to iPath, The Series B S&P 500 VIX Short-Term Futures ETN (VXX) is designed to provide exposure to the S&P 500 VIX Short-Term Futures Index Total Return. The layman meaning is this ETN attempts to provide hedgers an instrument by using short-term VIX futures bundled in a trading vehicle. This ETN is one of the largest ways for retail and professional investors to get exposure to the VIX futures market. Let’s take a look below at how the assets are flowing into this product and how much trading is taking place:

Assets over the past six months have gained from roughly $600 million to over $1.26 billion. The orange line shows the 30-day trading average of 25 million shares to over 35 million shares in October. We can also see that the VIX Index lost value as the VXX gained assets in trading. From my risk management seat, it appears the speculation of a higher VIX through instruments like VXX could actually be causing more volatility on itself. I know this is not a detailed quantitative look at the correlations, but let’s take a look at the next volatility exchange traded product below.

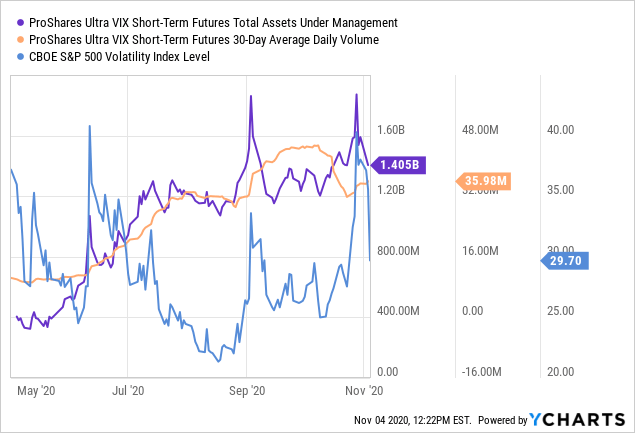

Again, we can see above where the ProShares Ultra VIX Short-Term Futures ETN (UVXY) is gaining assets and volume in a major way. If you will follow me here, we can see that volume in the UVXY has doubled in the past six months, along with the assets under management. The blue-line which represents the VIX has also gyrated from 25 to 40 in the past three months. Coincidence? Could it be that a higher VIX is attracting more capital to flow into these ETN products recently? Maybe. I actually believe it’s both. With more fear surrounding elections, the coronavirus and national lockdowns, investors are looking at ways to hedge out portfolios. While attempting to hedge, these same investors could actually be creating more volatility themselves. Nevertheless, should the average investor jump into the volatility trading craze? Absolutely not.

VIX ETF Caution

I encourage everyone reading this article to read all the great research that has already been published here on Seeking Alpha regarding the risks of these ETNs. However, I want to highlight the main risk here with UVXY, as it grows in more and more popularity among traders and investors. Also, if you are thinking of trading the UVXY or owning it as a hedge, you need to review the prospectus here. Below, we will highlight one main risk located in language from the UVXY prospectus:

The Funds may be highly volatile and generally are intended for short-term investment purposes only. Investing in the Funds involves significant risks not applicable to other types of investments. You could potentially lose the full principal value of your investment within a single day. Before you decide to purchase any Shares, you should consider carefully the risks described below together with all of the other information included in this Prospectus, as well as information found in documents incorporated by reference in this Prospectus.

Right from the…

Read More: UVXY And VIX ETF Assets Surging Among Election Uncertainties (NYSEARCA:UVXY)