Hong Kong stocks soar after China’s market regulator pledges support for city’s

The Hang Seng Index rose 1.54 per cent to 16,473.69 at 10am. The Tech Index rose 1.82 per cent, while the Shanghai Composite Index was flat.

Among the most heavily traded were gaming giant Tencent, which rose 3 per cent to HK$312.80 and insurer AIA, which added 2 per cent to HK$48.15.

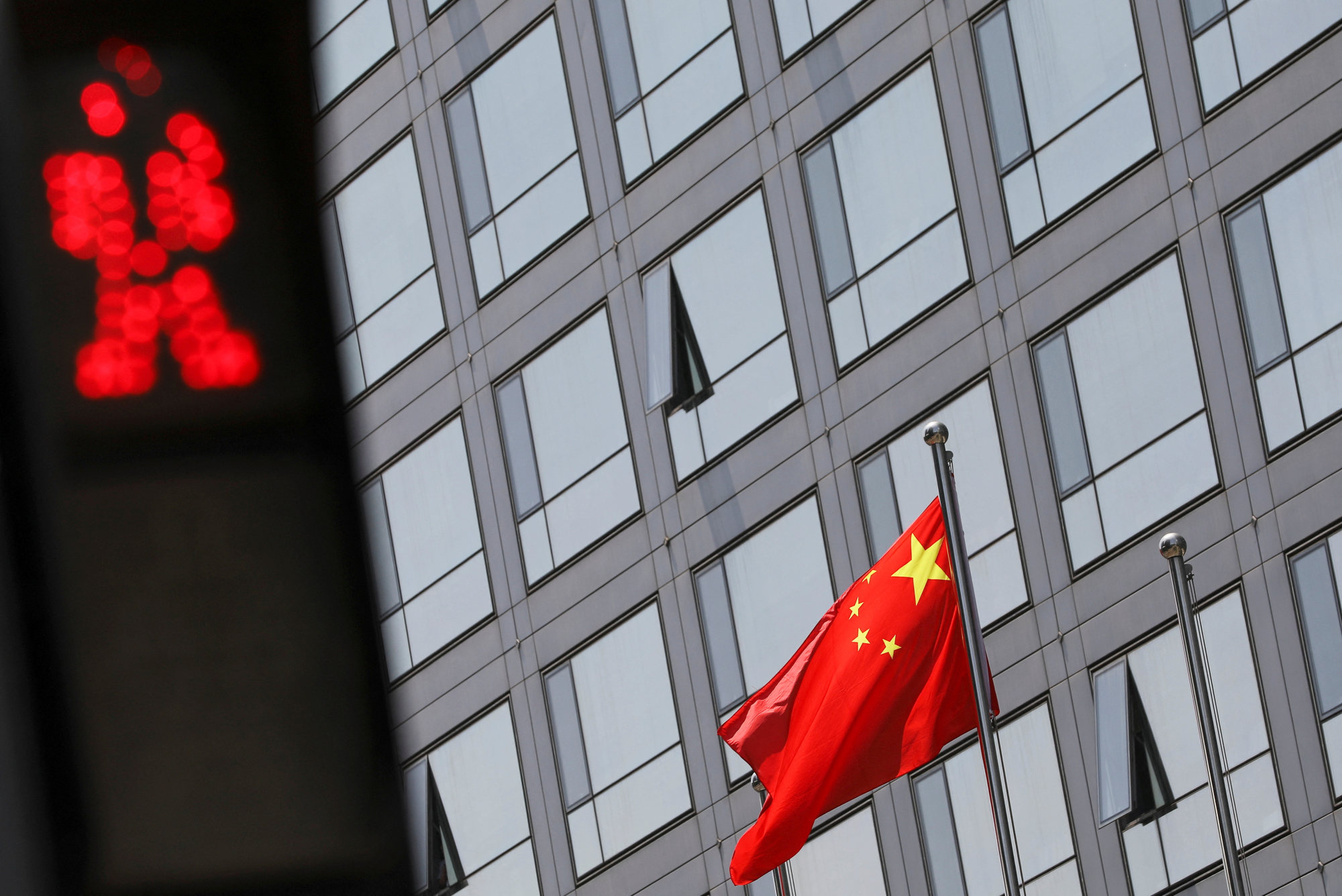

“The central government fully supports Hong Kong’s long-term maintenance of its unique status and advantages,” the CSRC said in an announcement after markets shut on Friday, reiterating President Xi Jinping’s message that “it is necessary to consolidate and enhance Hong Kong’s status as an international financial centre”.

Asian markets were broadly higher. Japan’s Nikkei 225 Index rose 0.55 per cent, Korea’s Kospi advanced 0.95 per cent while Australia’s S&P/ASX 200 climbed 1 per cent.

Read More: Hong Kong stocks soar after China’s market regulator pledges support for city’s