Will Bitcoin ETFs follow gold ETFs’ path to success?

Will the much-anticipated approval of spot Bitcoin ETFs be the catalyst for widespread adoption, or could it paradoxically hinder Bitcoin’s growth?

As of Dec. 11, the U.S. Securities and Exchange Commission (SEC) has not approved any spot Bitcoin (BTC) ETF applications despite growing interest and numerous filings from major financial entities.

This persistent reluctance stems from concerns about fraud and market manipulation, with the SEC emphasizing the need for a “comprehensive surveillance-sharing agreement with a regulated market of significant size.”

Historically, applications for Bitcoin spot ETFs have been repeatedly submitted and rejected. Notable investment firms like Ark Invest, Invesco, WisdomTree, VanEck, Bitwise, and Valkyrie have all faced rejections in their attempts to launch such products.

Despite these setbacks, the race for approval continues, with BlackRock, the world’s largest asset manager, recently filing a renewed ETF application. This move has sparked renewed hope in the crypto community, considering BlackRock’s successful track record with ETF applications.

But what does history tell us? Looking back at the gold market’s evolution post-ETFs, we see a path paved with increased demand and soaring prices – a path Bitcoin might well follow.

Yet, Bitcoin, with its unique digital nature and a market dynamic distinct from traditional assets like gold, presents a complex and multifaceted scenario.

Let’s delve into this intricate narrative, exploring the historical parallels, expert opinions, and economic implications of a world where Bitcoin spot ETFs are no longer a hypothetical but a reality. How will this impact Bitcoin’s trajectory, and what does it mean for investors, idealists, and the global financial landscape?

Gold vs Bitcoin: what does history tell us?

The history of gold ETFs offers valuable insights into how a potential approval of a Bitcoin spot ETF could impact the cryptocurrency’s market dynamics.

The first gold ETF, Gold Bullion Securities, was launched on the Australian Securities Exchange in March 2003, followed by the launch of SPDR Gold Shares (GLD) in the United States in November 2004. This marked a significant shift in how investors could access the gold market.

Before the advent of gold ETFs, investment in gold was typically done through physical gold purchases or shares in gold miners, which offered leverage to gold prices.

Physical gold, however, had several drawbacks, such as sales tax, storage costs, and regulatory constraints, making it less accessible to the average investor.

The introduction of gold ETFs democratized gold investment, offering a more straightforward and cost-effective way to invest in gold without owning it physically. This ease of access played a pivotal role in increasing gold’s appeal to a broader range of investors.

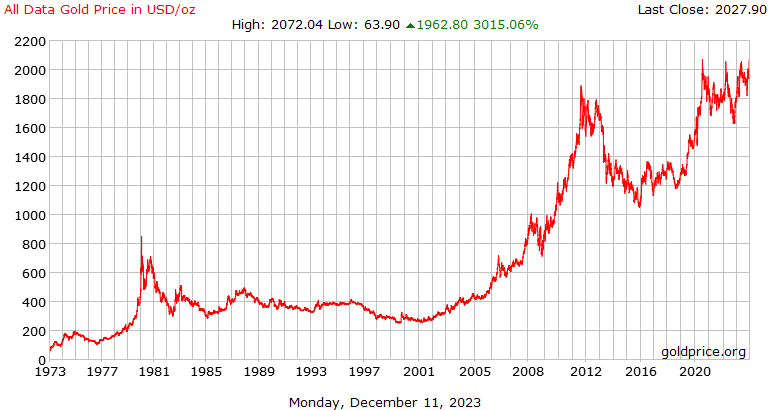

The impact of gold ETFs on the market was substantial. The gold price, which had been in decline from its peak in 1980, began to rise steadily after central bank selling stopped and VAT was removed on physical gold purchases.

Following the launch of the first gold ETF, gold prices experienced a significant increase. Between 2004 and 2011, gold price soared from around $450 to more than $1,820, marking a nearly 350% increase.

Drawing parallels to Bitcoin, the approval of a Bitcoin spot ETF could potentially have a similarly transformative effect.

A Bitcoin spot ETF would provide direct exposure to Bitcoin’s price, making it more accessible to a wider range of investors, including those less inclined to navigate the complexities of cryptocurrency exchanges or digital wallets.

This increased accessibility could lead to higher demand and potentially drive up Bitcoin’s price.

However, it’s crucial to consider the differences between gold and Bitcoin markets. Bitcoin’s market dynamics, regulatory environment, and investor profile differ significantly from those of gold. While history can provide insights, the impact of a Bitcoin spot ETF could manifest differently due to these unique factors.

What do experts think?

Nitin Gaur, Global Head of Digital Asset and Technology Design at State Street, opines that Bitcoin ETFs could usher in a transformative era for Bitcoin’s market dynamics. He says:

“The approval of Bitcoin ETFs is not just a regulatory milestone; it’s a gateway to unprecedented capital inflows into the Bitcoin ecosystem. Post-approval of these spot Bitcoin ETFs, we could witness Bitcoin’s price soaring past $60k levels by the next halving event.”

Gaur also emphasized the broader implications beyond the price jumps, focusing on how Bitcoin spot ETFs could fundamentally alter Bitcoin’s long-term viability and acceptance in the financial ecosystem. He…

Read More: Will Bitcoin ETFs follow gold ETFs’ path to success?