What is Veritaseum (VERI)? A Beginner’s Guide

“At it’s [sic] simplest, Veritaseum is the gateway to peer-to-peer capital markets,” the project’s website proclaims. The platform opens investor access to smart contracts and financial machines that allow them to manage their investments and transfer values with other Veritaseum users.

The platform’s goal is to eliminate brokers, financial advisors, banks, and other middlemen from the capital markets ecosystem, and its team would actively reject any labels that accuse Veritaseum of acting as these roles in their stead. Rather, they believe that Veritaseum is merely a vendor of services, a “distributed, serverless software” that allows its users to act both as the consumer and the middlemen the software is replacing.

How Does Veritaseum Work

On a fundamental level, Veritaseum offers its users the tools and software to engage in a peer-to-peer capital market. Using VERI, the platform’s utility token, users can purchase access rights to the smart contracts that manage the platform’s services.

These products range from self-custody escrow services to financial analytics/research data and even asset tokenization. All of these services make up the collective Veritaseum platform, and each can be accessed independently from each other.

At the time of this writing, only one product, VeADIR, has an active beta.

[thrive_leads id=’5219′]

VeADIR

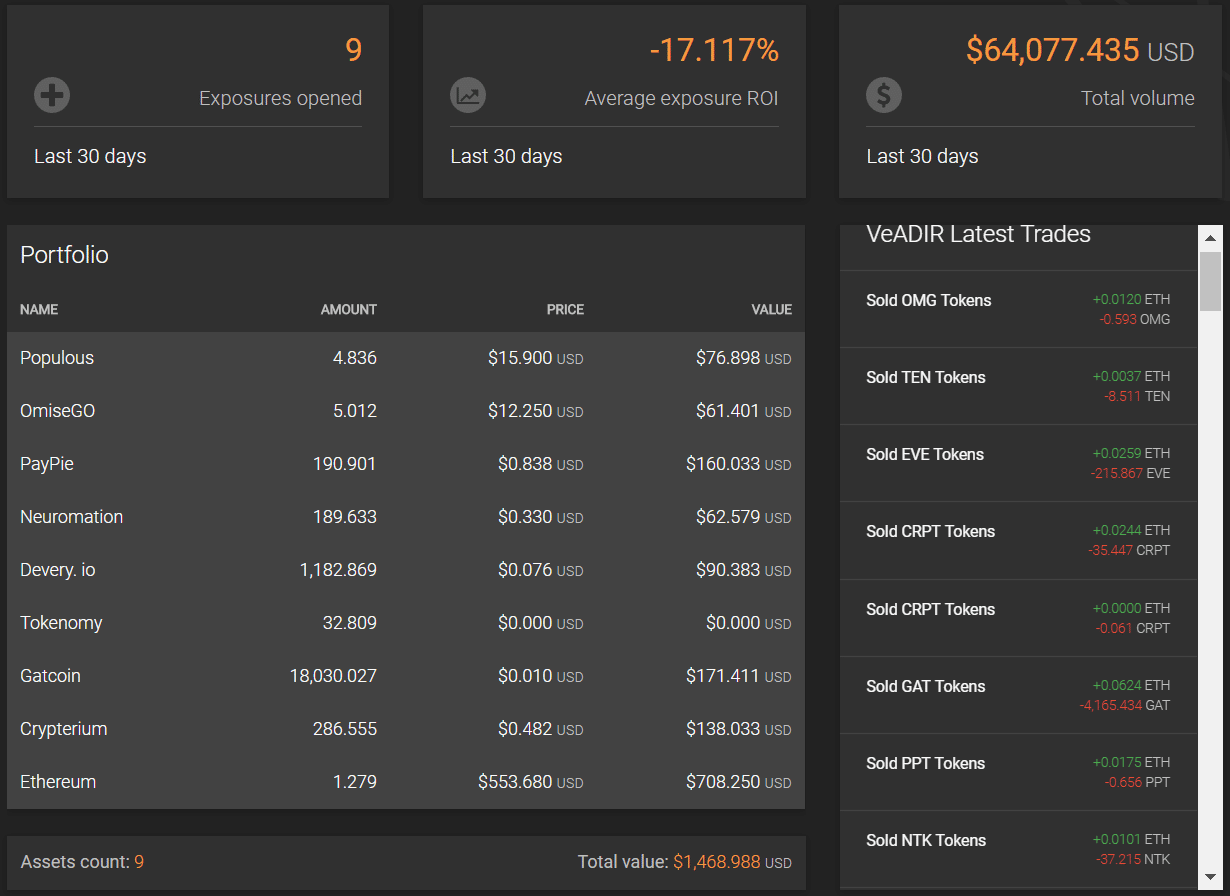

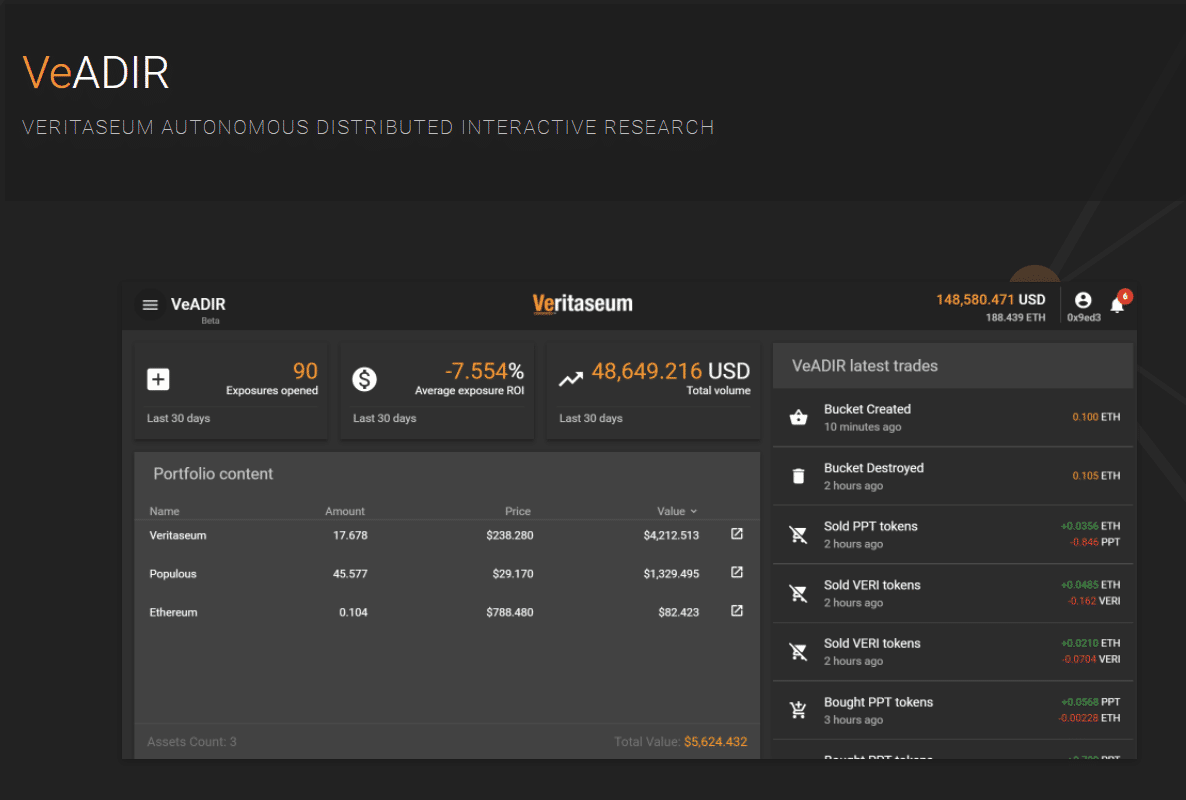

Short for Veritaseum Autonomous Distributed Interactive Research, VeADIR is the platform’s research muscle. VeADIR pulls data from Veritaserum in exchange for VERI, and interested parties, in turn, can pay for these research findings. All of the findings are presented in machine language algorithms, though, so users will have to use a smart contract to translate them into a common vernacular.

In addition, users can request data by asking VeADIR questions on a pay-per-query basis, and this feeds the research models. If users request research on a certain organization, VeADIR pays this organization VERI for this information. On the flip side, an entity can petition VeADIR to be analyzed and compensated in VERI, as well.

VeADIR also makes purchases based on this research, such as investing in a platform token or distressed credit. It then constructs a “model portfolio” dictated by its findings, and platform users can likewise purchase these portfolios on a periodic basis.

To give you a rundown of how this would work, here’s a quick example:

Jim Bob Cooter’s Bourbon Street Investment Group wants to put money into an ICO, but they want comprehensive data on this ICO, the industry they’re trying to disrupt, and other relevant investor information.

Jim Bob et al then submit a request to VeADIR and fill out a questionnaire with the data they would like to receive. VeADIR pools this information from the ICO and sends it to Veritaseum for processing.

After Veritaseum crunches the data, VeADIR retrieves the completed research, and Jim Bob Cooter’s Bourbon Street Investment Group then pays for the information and converts it from machine language to English (or French if they’re those kind of Cajuns).

VeRent

VeRent is the platform’s economic rent facility. The concept here is simple: it’s the tool with which users can participate in peer-to-peer token transactions.

Basically, you make an offer on the platform, setting how much of a coin/token you’re listing, the price you’ll trade for it, and the duration of the offering. It’s unclear the range of offerings that VeRent will accommodate, but as of now, it appears that VERI, ETH and a handful of ERC20 tokens are available on the service.

The team denies that VeRent functions as an exchange, but to be blunt, it facilitates currency trades between users so it’s unclear (to this author at least) how this deviates from any other exchange platform.

VeResearch

The human counterpart to VeADIR, VeResearch is the platform’s research vehicle driven by man-made modules.

With VeResearch, the Veritaseum analytics team constructs investment models for any crypto asset the platform analyzes. These models are meant to work in tandem with those built by VeADIR, though investors will likely be able to purchase them separately (the website is not clear as to how users may go about accessing these models, though).

VeExposure

“VeExposure is the realization of man (VeResearch) and machine (VeADIR) working in concert to drop expenses and increase performance, while allowing users to maintain custody, ownership and control of their assets (private keys),” according to Veritaseum’s website.

All of that to say, VeExposure essentially serves as the app that gives users access to the “exposures” (i.e., data)…