The Breakout In Bitcoin Is Here: These 3 Stocks Can Climb Higher

Bitcoin (BTC-USD) has quietly staged an impressive rally this year. We’re watching on an ongoing breakout as the price of Bitcoin has climbed above the important $12,000 level which represented an important technical resistance level. At the current price of $12,729, Bitcoin is now approaching the highest daily closing price since early 2018, and up by more than 75% year to date.

(Source: finviz.com)

We believe the market dynamics are extremely bullish supporting continued momentum in the broader cryptocurrency space. In many ways, the volatile trading environment for Bitcoin in recent years has been positive bringing greater scrutiny to the emerging asset class and helping to consolidate long-term support. Indications are that institutional investors are taking Bitcoin and cryptocurrencies seriously driving inflows into the segment.

Our bullish case for Bitcoin draws a lot of similarities to the themes supporting higher prices in gold (GLD) and precious metals. Simply, as an alternative to traditional fiat currencies, Bitcoin benefits as a store of value against the unprecedented wave of aggressive quantitative easing and dovish monetary policies by global Central Banks which have flooded the market with liquidity. The low interest-rate environment coupled with significant ongoing macro uncertainties supports the demand for an asset with constrained supplies.

Bitcoin as the first and largest cryptocurrency can be seen as the “gold” of asset class where a rising tide can lift all other “altcoins”. We expect Ethereum (ETH-USD), Ripple (XRP-USD), Litecoin (LTC-USD), and Tether (USDT-USD) among others to all benefit from the similar dynamics.

There have been several positive headlines supporting sentiment towards the segment, including reports that PayPal Holdings Inc. (PYPL) will accept cryptocurrencies as payments starting in 2021. As one of the largest payment service providers, PayPal opening the door for cryptocurrencies supports more mainstream adoption.

Separately, indications that the SEC continues to look into approving a “Bitcoin ETF” like the pending Winklevoss Bitcoin Trust ETF (COIN) or VanEck SolidX Bitcoin Trust ETF (XBTC) further add legitimacy to the crypto space. More importantly, the adoption of underlying blockchain technologies and distributed ledger concepts across various sectors support positive sentiment. Overall, the long-term outlook is improving and we believe cryptocurrencies are here to stay and prices can climb higher.

How to Trade Bitcoin with Stocks

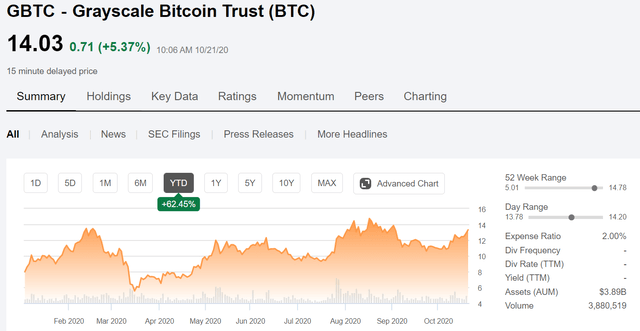

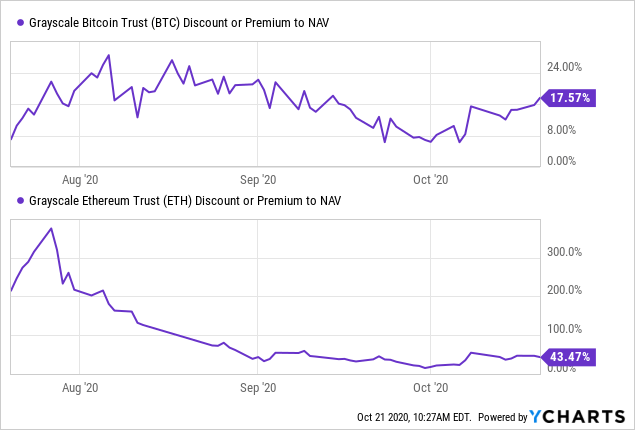

While the SEC is still debating the approval of Bitcoin and cryptocurrency exchange-trade-funds, existing alternatives in the market include a series of funds sponsored by Grayscale Investments LLC. The Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (OTCQX:ETHE) are two of the largest examples with a structure more closely related to a closed-end fund and trade over-the-counter.

(Source: Seeking Alpha)

While GBTC and ETHE invest directly in Bitcoin and Ethereum, the share prices currently trade at a large premium to the underlying net asset value of their holding. Essentially, investors are paying more for each share of GBTC and ETHE than the implied value of underlying fund holdings.

On its own, a premium to NAV is not necessarily a deal-breaker as the share price can still climb higher as Bitcoin and Ethereum prices rise. Our concern is that if an announcement is made over the coming months that an ETF will be approved by the SEC, we would expect the premium to collapse towards parity or even trade at a discount-driven by a rotation in the market towards the most liquid vehicle. Depending on the pricing environment and cost basis, investors could face an incremental capital loss due to this dynamic. For this reason, we recommend avoiding both GBTC and ETHE as a long-term holding but think they can be an option for short-term trading.

There are also several stocks that represent direct or indirect exposure to higher cryptocurrency prices and sentiment towards the asset class. Here are our three favorites.

1. Riot Blockchain Inc. (RIOT)

(Source: finviz.com)

With a market cap of approximately $200 million, Riot Blockchain Inc. is one of the largest pure-plays on cryptocurrencies. The company owns thousands of dedicated specialized Bitcoin mining machines and continues to expand its hardware fleet. Essentially, the core business is the purchase of the mining equipment that can generate a consistent flow of bitcoins while covering costs like energy consumption. The company can benefit from higher prices of Bitcoin which can drive revenues higher through operating leverage. Separately, the company also owns several blockchain companies including ‘Tesspay’ and ‘Verady’ which seek to deploy solutions…

Read More: The Breakout In Bitcoin Is Here: These 3 Stocks Can Climb Higher