Medicare Advantage Plans: How to Compare | Personal-finance

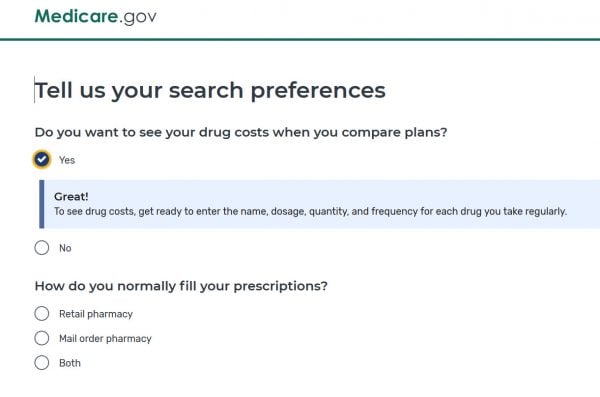

If you want to see drug costs when you compare plans, you can enter the name, dosage, quantity and frequency for each drug you take regularly — and even the pharmacy where you get prescriptions filled. The final list will then be populated with your expected drug costs in each plan. Filter plans by available benefits, plan type, ratings, insurance carrier and drug coverage options. Select up to three plans for side-by-side comparison.

A screenshot from Medicare’s Plan Finder tool.

If you’re a little overwhelmed by online tools, you can find live human help from State Health Insurance Assistance Programs (called the SHIP network). “It’s basically the equivalent of a hotline or in-person counseling,” says Riaz Ali, CEO and founder of health care solutions company Saeidan and creator of plan comparison site Ask Claire. “They will not recommend a plan, but they can help you through the process.” Each state has its own SHIP program — find your local program at shiptacenter.org.

What Medicare Advantage Plans are available?

There are five types of Medicare Advantage Plans:

- Health maintenance organization, or HMO, plans: Require you to see an in-network provider unless it’s an emergency situation, and most require a referral to see a specialist.

- Preferred provider organization, or PPO, plans: Allow you to see both in-network and out-of-network health care providers, although it’s usually more expensive to go out of network.

- Private fee-for-service, or PFFS, plans: Allow you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you. You may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more.

- Special needs plans, or SNPs: Provide benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. These plans also provide benefits to people with a limited income.

- Medical savings account, or MSA, plans: Combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

Read More: Medicare Advantage Plans: How to Compare | Personal-finance