Macro Week Ahead: Will Stock Markets Find a Lifeline in U.S. GDP, PCE and PMI

Stock markets may try to recovery while the dollar gives back some recent gains as financial markets digest U.S. PMI, GDP and PCE inflation data ahead of next week’s Fed policy meeting

- April PMI data may narrow Fed vs. ECB vs. BOE policy bets, hurt U.S. dollar.

- Stocks may try to recover absent an upside surprise on Q1 U.S. GDP data.

- U.S. PCE inflation data unlikely to change traders’ interest rate cut calculus.

Wall Street faced heavy selling pressure last week.

The bellwether S&P 500 shed 3.1% and the tech-tilted Nasdaq 100—the centerpiece of the equities rally from late October and through the first quarter of 2024—lost 5.4%. This marks the third consecutive week that both indexes have declined.

Treasury bonds fell as yields continued to march higher across the curve. The U.S. dollar rose for a second week against its major peers, albeit at a slower pace. Crude oil prices fell as worries eased about tit-for-tat escalation between Israel and Iran. Gold prices rose for a fifth consecutive week.

Here are the macro waypoints that are likely to shape price action in the week ahead.

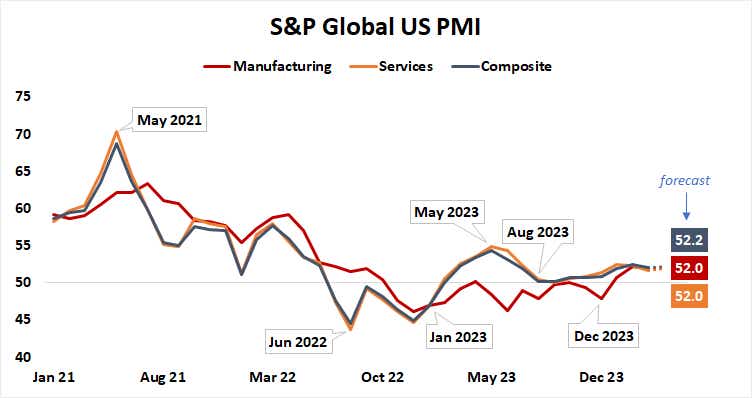

U.S. PMI data

April’s U.S. purchasing managers index (PMI) data is expected to show that the pace of economic activity growth continued to hover in familiar territory for a fourth consecutive month. The pace of expansion in the manufacturing and services sectors leveled up in January after a relatively anemic second half of 2023 but struggles to accelerate from there.

Analog numbers from the Eurozone and the U.K. are penciled in for peppier results. While both economies are growing slower than the U.S., numbers showing an attempt to narrow the gap might echo into monetary policy bets. If that shrinks the U.S. dollar’s expected yield advantage against the euro and the British pound, the greenback may weaken.

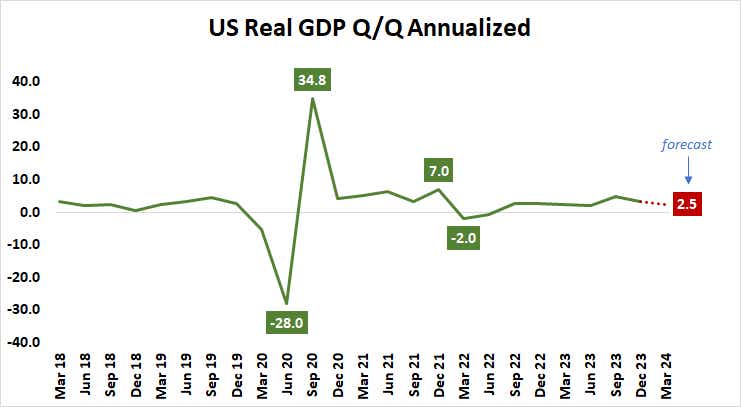

U.S. gross domestic product (GDP) data

Economic growth is expected to have slowed in the first quarter. Experts expect output to expand at an annualized rate of 2.5%, down from the 3.4% recorded in the three months to December 2023. Analytics from Citigroup show U.S. data outcomes have cooled a bit relative to baseline forecasts, warning of a somewhat soggy outcome.

The markets’ Federal Reserve monetary policy expectations have already shifted to a significantly more hawkish setting than the central bank itself, pricing in just 32 basis points (bps) in cuts this year compared with officials’ call for 75 bps. A slightly softer print might hint traders have overshot, lifting stocks and bonds while pressuring the dollar.

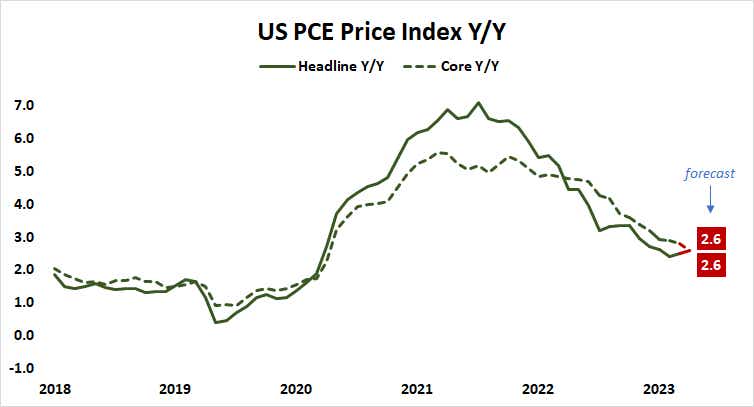

U.S. personal consumption expenditure (PCE) data

Analysts expect the Fed’s favored measure of inflation to show that headline price growth picked up a bit, rising to 2.6% in March from 2.5% in the prior month. The core rate excluding volatile food and energy prices—a focal point for policymakers—is expected to edge down from 2.8% to 2.6%.

On balance, the PCE measure can be calculated with relative accuracy having seen consumer and producer price index (CPI and PPI) numbers for the same period, so a significant deviation from median projections seems unlikely. Absent an eye-catching deviation and with a Fed rate decision due May 1, the markets may opt to look through this release.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Read More: Macro Week Ahead: Will Stock Markets Find a Lifeline in U.S. GDP, PCE and PMI