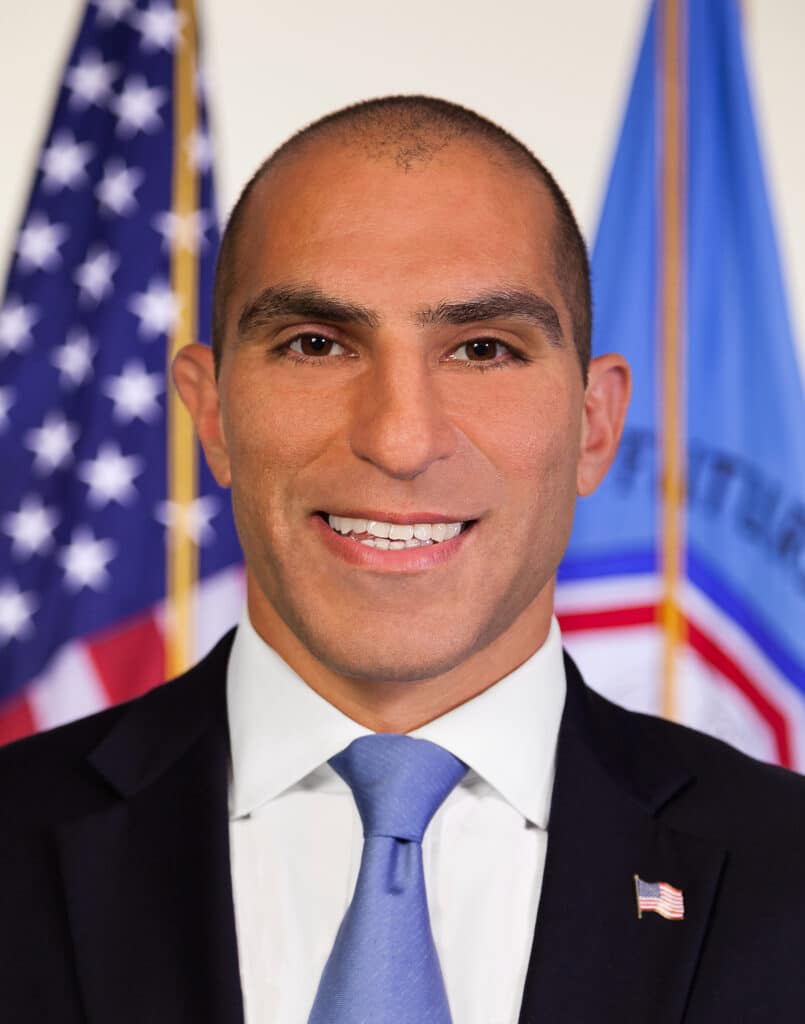

Keynote Of CFTC Chairman Rostin Behnam At The FIA Boca 2024

Introduction

Good morning and thank you, Alicia, for the kind introduction.

There may be a few FIA Futures Hall of Fame members in the audience who know or can recall the origin of the CFTC. This October, the CFTC will commemorate the 50th anniversary of the passage of the Commodity Futures Trading Commission Act of 1974.[1] The Act established the CFTC as an independent agency with exclusive jurisdiction over futures trading in all commodities.[2] Next year, we will mark the 50th anniversary of the swearing in of the first four Commissioners and the official transfer of authority from our predecessor in the U.S. Department of Agriculture to the CFTC. This 50th milestone is referred to as a golden anniversary or jubilee.

Many of us are familiar with the phrase to “Stay gold, Ponyboy,” a quote from S.E. Hinton’s The Outsiders[3]—which is actually a reference to Robert Frost’s poem “Nothing Gold Can Stay.”[4] It’s a phrase used to remind someone to stay true to their convictions—to have personal strength, because change is inevitable. The “golden standard” is therefore, so to speak, having the strength and principles to show up every day, and meet the challenges of constant change and unavoidable conflicts together. In this current era, many of our issues wrestle with transition and acknowledging new market realities in the derivatives industry that may require changes in the way we regulate our markets.

If you have been in attendance these last few years, this all may sound familiar. In 2022, I remarked that our collective dedication was a testament to our resilience as an industry.[5] Last year, I acknowledged that the modern futures ecosystem was taking off.[6] I invited you to show up, and to be generous with your time, comments, input, and feedback. And I am showing up today to again ask that, if you believe in the derivatives markets and feel strongly about the direction we are moving in, that you engage, meaningfully.

Before sitting down with Walt, I would like to provide a brief overview of the CFTC’s current priorities.

The Current Agenda

In early 2023, I outlined a Commission agenda to consider and vote on roughly 30 regulatory and policy matters in addition to all of the rules and orders proposed in the prior year.[7] I bucketed them into themes that addressed the following: risk management and resilience; customer protections; efficiency and innovation; reporting and data policy; duplicative regulatory requirements; and international comity.

Underlying all of these themes is the need for our ruleset to address the derivatives industry’s current course as a few seek to move away from the traditional and familiar model towards structures that combine unique activities. I touched upon these concepts in 2022, identifying disintermediation and decentralized finance as the dominant disruptors of our current era, raising important questions about conflicts of interest, the strength of capital, margin, and segregation requirements, the role and responsibilities of self-regulatory organizations, affiliate risk management, and, of course, customer protections.[8]

I was not surprised that by last summer, vertical integration, an outgrowth of electronification and DeFi,[9] had grown. Our markets are no longer physically delineated by geographical separation of activities among distinguishable market actors. And, to be clear, there is nothing per se unreasonable or problematic about innovative approaches. The bottom line is that, when presented with legally sound proposals to facilitate the transfer and mitigation of financial risk, we must engage, grapple with the questions they raise and ask our own, apply pressure—sometimes a healthy dose, be transparent, and move with caution and collective wisdom.

As I’ve consistently stated, our role is to regulate a market, ensure integrity and resilience, and protect customers.

Accordingly, last summer I directed staff to draft and issue the Request for Comment on the Impact of Affiliations on Certain CFTC-Regulated Entities (the “RFC”).[10] Your comments have been received and reviewed, and I anticipate that by the summer the Commission will consider a proposal specifically addressing potential risks, conflicts, and governance issues that may be raised by new market structures and affiliate relationships.

Ultimately, I envision that while any new policy will be informed in part by the comments received in the RFC and the Commission’s real-time observations, the goal is to continue using, as a template and anchor, the models and structures that have been time-tested and developed over decades to promote market resiliency and…

Read More: Keynote Of CFTC Chairman Rostin Behnam At The FIA Boca 2024