Income Required To Afford A Typical Home By City In 2024

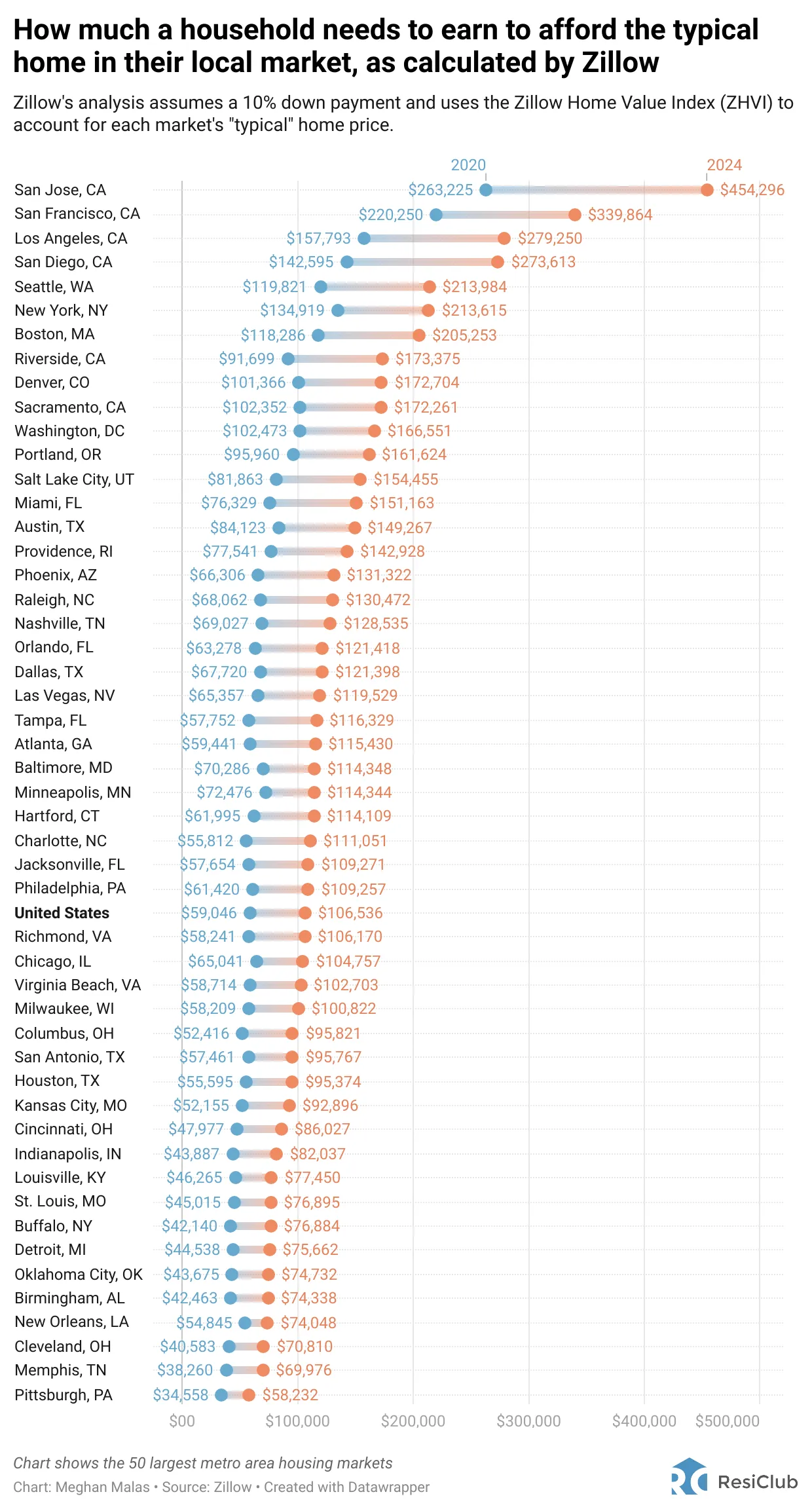

Zillow recently released an intriguing study that outlines the income needed to afford a “typical home” in different cities. The study considers a 10% down payment and utilizes the Zillow Home Value Index to determine the median home price in each city.

A 10% down payment is 10% lower than I’d recommend, but it’s Zillow’s exercise. Let’s compare the income required to purchase the median home in each city between 2020 and 2024. These are the top 50 city metros in America.

San Jose commands the highest income requirement to afford a median home at $454,296, while Pittsburg boasts the lowest income needed at just $58,232. If homeownership is a priority and budget constraints are a concern, perhaps a move to Pittsburgh, Pennsylvania, is worth considering!

As a San Francisco resident, I find it reassuring that the cost of living here is only $339,864. This represents a substantial $114,432 reduction in the required annual income, or 25%, compared to the income needed for homeownership in San Jose.

Furthermore, when it comes to lifestyle considerations, San Francisco offers a more picturesque, lively, and enjoyable environment compared to San Jose. It’s not San Jose that draws world travelers to the U.S., but rather the allure of San Francisco!

Expensive Cities Might Actually Be The Cheapest Cities To Live In

You’ve read my post titled “Why Households Need To Earn $300,000 A Year To Live A Middle-Class Lifestyle Today.” While you might have strongly disagreed with my analysis concerning families residing in expensive coastal cities, it’s reassuring to find external validation from Zillow supporting it.

The United States is vast, with varying cost-of-living levels across the country. Fortunately, we all possess the freedom to choose where we want to live.

If the cost of living becomes too burdensome for our income, we have the option to relocate, trim expenses, or seek additional work, as we are all rational decision-makers.

Despite cities such as Boston, New York, Seattle, San Diego, Los Angeles, San Francisco, and San Jose necessitating over $200,000 in household income to afford a typical home, I argue that these cities are more affordable than commonly perceived.

Here are two reasons why.

1) Expensive cities are cheaper to have fun and live healthier

As I wrote in my post about private sports clubs, I pay $180 a month to be a part of a network of clubs in the Bay Area. I think $180 a month is great value, which is why I’m unwilling to cut the expense despite no longer being financially independent.

Then Nate, a reader from Pittsburgh, PA chimed in and wrote,

“Very weird a private sports club with indoor pickleball and tennis would only cost $180/m. Obviously you wouldn’t cancel this. There is no such thing as private indoor sports club for $180/month in Pittsburgh. Only country clubs with outdoor tennis or pickleball and golf for $1,500/m and up. Other option is public park for tennis or pickleball which involves waiting/no reservations/no availability.”

Holy moly! $1,500 a month and up to be able to play tennis and pickleball indoors? No thank you! Who can afford that?

$18,000 a year for sports club membership dues while it only takes $58,232 in income to afford a typical house is an absurd ratio.

Nicer Weather Matters For Quality Of Life

Here in San Francisco, the weather remains moderate throughout the year, providing ample free public courts for tennis and pickleball. In this example, private sports club memberships are at least 88% more affordable.

For those seeking cost-effective outdoor enjoyment almost year-round, cities like San Jose, San Francisco, Los Angeles, and San Diego offer favorable conditions. However, in areas where the required income is less than the overall U.S. income of $106,536 to afford a home, maintaining a year-round outdoor lifestyle is more challenging.

Improved weather stands out as one of the crucial reasons why living on the West Coast surpasses living on the East Coast. Having experienced both coasts for over a decade each, I can attest to the significantly higher quality of life.

Life is already brief, and enduring three to four months of extreme winter conditions annually is suboptimal for many Americans. Consequently, a substantial number of Americans opt to relocate out west or south to Florida.

For those prioritizing favorable weather and homeownership, cities like New York City ($213,615) and Boston ($205,253) might not be the best choices.

Given their high-income requirements for housing and challenging weather conditions, a strategic move could involve geoarbitrage to more affordable and warmer cities on the east coast like Miami ($151,163), Raleigh…

Read More: Income Required To Afford A Typical Home By City In 2024