Huaneng Power: All Eyes On Coal Fired Power Exposure And Dividends (NYSE:HNP)

Elevator Pitch

I assign a Neutral rating to Chinese independent power producer or IPP Huaneng Power International (HNP) [902:HK].

Huaneng Power was a beneficiary of low coal prices in 3Q 2020, as its net profit more than doubled YoY thanks to a -8% YoY decrease in operating costs. Going forward, coal prices are expected to remain stable in the near-term, which should be supportive of the company’s profitability. On the other hand, Huaneng Power’s high dividend yield and generous dividend payout ratio could be under threat due to significant investments in new renewables capacity and asset impairment losses.

Huaneng Power trades at 5.5 times consensus forward FY 2021 P/E, and it offers a consensus forward FY 2021 dividend yield of 11.0%.

Company Description

Huaneng Power International is one of the largest independent power producers or IPPs in China with a total installed capacity of 108,111MW and an equity-based installed capacity (based on proportionate equity interest in various power projects) of 94,878MW as of June 30, 2020.

It is notable that Huaneng Power has significant exposure to coal-fired power plants as a proportion of its total power portfolio, with non-coal renewable energy sources only accounting for 18.16% of the company’s total installed capacity.

A Beneficiary Of Lower Coal Prices In 3Q 2020

Huaneng Power reported its 3Q 2020 financial results on October 27, 2020, and the company’s financial performance in the third quarter of this year was ahead of market expectations.

The company’s net profit attributable to shareholders more than doubled from RMB1,565 million in 3Q 2019 to RMB3,401 million in 3Q 2020. Although Huaneng Power’s revenue declined -3% YoY to RMB42,702 million in the third quarter of the year, this was more than offset by a -32% YoY decrease in financial expenses and a -8% YoY decline in operating costs. The drop in financial expenses in 3Q 2020 was mainly attributable to lower interest rates on a YoY basis.

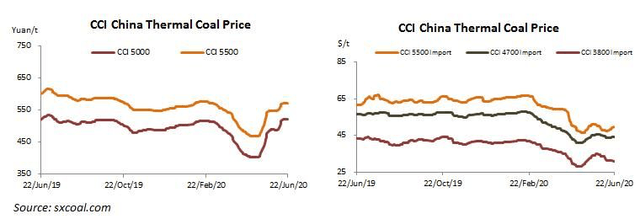

The decline in operating costs is a more significant contributor to Huaneng Power’s earnings growth in 3Q 2020, as operating costs fell by more than RMB3 billion YoY in the most recent quarter, compared with a RMB1 billion decline in financial expenses over the same period. More specifically, Huaneng Power was a beneficiary of lower energy costs, with china thermal coal price on the decline since the start of the year.

China Thermal Coal Prices

But there is no certainty that domestic coal prices will remain low for a sustained period of time. At the company’s 1H 2020 earnings call (audio recording and transcript not publicly available) on August 19, 2020, Huaneng Power guided that demand and supply of coal should be relatively balanced in 2H 2020, implying stable coal prices. This suggests that Huaneng Power’s 4Q 2020 operating costs should not decrease to a similar degree as that of 3Q 2020, but a spike in coal prices in 4Q 2020 is also unlikely. More importantly, the Chinese authorities wish to maintain coal prices at a moderate level that is comfortable for both coal miners and power producers. In a July 24, 2020 article by Fitch Ratings, it is noted that “the government has utilized various policy tools to manage coal prices in recent years.”

On the flip side, China is making a strong push for renewable and clean energy. For the 13th Five-Year Energy Development Plan for the 2016-2020 period, China set a target for coal-fired capacity to account for 58% of the country’s primary energy by 2020, and the target was achieved in 2019 with coal-fired capacity representing 57% of its primary energy.

Looking ahead, China’s new 14th Five-Year Energy Development Plan aims to slow coal consumption growth in China to a CAGR of +1% for the next five years for the 2021-2025 period, and the number of domestic coal mines is expected to be reduced from 5,300 in 2019 to 4,000 by 2025. This also means that China is likely to impose stricter regulations on pollution relating to coal-fired power plants. With coal-fired power plants representing over 80% of the company’s total installed capacity, Huaneng Power has to make a shift towards renewables, which is the subject of the next section of this article.

Making A Shift Towards Renewables

Huaneng Power guided at its earlier 1H 2020 results briefing on August 19, 2020 that the company has set a target of increasing its renewable energy capacity by 5GW every year for the next three years, of which one-third will be solar energy and the other two thirds attributable to wind energy. On the continued shift towards renewables, Huaneng Power acknowledged that coal-fired power as a proportion of China’s total energy output will continue to decline. But Huaneng Power expects that there will be a tipping…

Read More: Huaneng Power: All Eyes On Coal Fired Power Exposure And Dividends (NYSE:HNP)