Could The Market Be Wrong About Shanxi Coal International Energy Group Co.,Ltd

Shanxi Coal International Energy GroupLtd (SHSE:600546) has had a rough month with its share price down 12%. However, a closer look at its sound financials might cause you to think again. Given that fundamentals usually drive long-term market outcomes, the company is worth looking at. Specifically, we decided to study Shanxi Coal International Energy GroupLtd’s ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company’s management is utilizing the company’s capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Shanxi Coal International Energy GroupLtd

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for Shanxi Coal International Energy GroupLtd is:

42% = CN¥8.8b ÷ CN¥21b (Based on the trailing twelve months to September 2023).

The ‘return’ refers to a company’s earnings over the last year. That means that for every CN¥1 worth of shareholders’ equity, the company generated CN¥0.42 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or “retains” for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don’t necessarily bear these characteristics.

Shanxi Coal International Energy GroupLtd’s Earnings Growth And 42% ROE

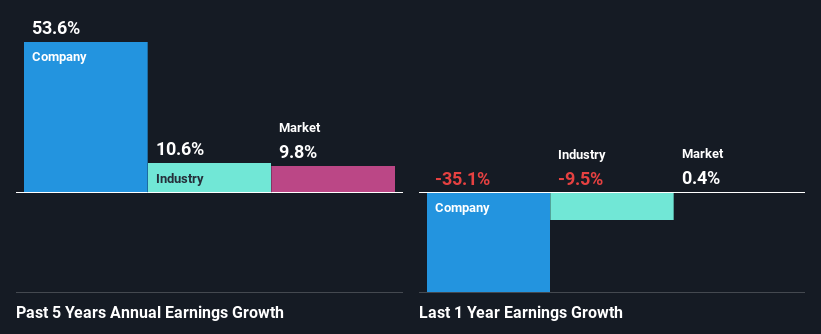

First thing first, we like that Shanxi Coal International Energy GroupLtd has an impressive ROE. Secondly, even when compared to the industry average of 7.4% the company’s ROE is quite impressive. Under the circumstances, Shanxi Coal International Energy GroupLtd’s considerable five year net income growth of 54% was to be expected.

Next, on comparing with the industry net income growth, we found that Shanxi Coal International Energy GroupLtd’s growth is quite high when compared to the industry average growth of 11% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company’s expected earnings growth (or decline). Doing so will help them establish if the stock’s future looks promising or ominous. What is 600546 worth today? The intrinsic value infographic in our free research report helps visualize whether 600546 is currently mispriced by the market.

Is Shanxi Coal International Energy GroupLtd Using Its Retained Earnings Effectively?

Shanxi Coal International Energy GroupLtd has a three-year median payout ratio of 50% (where it is retaining 50% of its income) which is not too low or not too high. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Shanxi Coal International Energy GroupLtd is reinvesting its earnings efficiently.

Moreover, Shanxi Coal International Energy GroupLtd is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years.

Summary

On the whole, we feel that Shanxi Coal International Energy GroupLtd’s performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company’s fundamentals? Click here to be taken to our analyst’s forecasts page for the company.

Valuation is complex, but we’re helping make it simple.

Find out whether Shanxi Coal International Energy GroupLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not…

Read More: Could The Market Be Wrong About Shanxi Coal International Energy Group Co.,Ltd