Will there be a diesel fuel shortage in 2023?

Saudi Arabia and Russia this month each elected to extend cuts in production of heavy crude oil through the rest of the year, just as U.S. seasonal demand begins to trend up. Heavy crude oil is the base for both heating oil and diesel fuel, and through the winter months refineries have to balance production of the two distillates with, generally, whichever is priced higher winning the lion’s share of production.

A lack of the preferred heavy crude means refineries are working harder and processing more volume, but with less yield.

“We are running about 700,000 barrels per day more crude than we were on this day a year ago,” said Tom Kloza, chief oil analyst and global head of energy analysis at Oil Price Information Service (OPIS), “but we’re running almost exclusively light sweet crude, which has a low diesel yield, and we’re making about 10,000 less [barrels] distillate each day. That presents a problem for now through November.”

Kloza said the likelihood that the U.S. will build distillate inventories to a comfortable level by Thanksgiving “is very low,” yet despite this risk few traders are willing to stock up on diesel and heating oil ahead of the winter, he added.

“There is too much backwardation in the price. Price is much lower 60-90 days out. That structure doesn’t favor inventory accumulation and it sets up a repeat of last year where inventories are dangerously low coming into winter,” Kloza said.

Distillate inventories last year hit their lowest level since 2008, according to the Energy Information Administration (EIA), just as diesel prices crested back over $5 per gallon. In October, distillate levels reached a low-point not seen in that month since 1982, however, a widespread shortage at the fuel island didn’t materialize. The level of U.S. distillate fuel oil stock has been building since early August and is currently about 122 million barrels, about 15 million more than what was available in the trough of October 2022 before rebounding to almost 120 million to end last year.

Will there be a diesel fuel shortage?

Diesel inventories are low, according to David Fialkov, executive vice president of government affairs for both NATSO and SIGMA, the trade organizations for fuel marketers and truck stops, but “the market is adjusting to get product where it needs to be as efficiently as possible. The low inventory levels leave us exposed to sudden increases in demand or decreases in supply,” he added. “For example, if a major refinery shuts down for a period of time, the cause for concern could increase.”

A spokesperson for Love’s Travel Stops told CCJ Wednesday the company sees “a potentially tight market if we have a really cold winter, but Love’s will continue to leverage (Love’s subsidiaries and fuel haulers) Musket and Gemini to keep locations stocked as best as possible.”

Pilot Company Vice President of Supply and Distribution Ted Brennan said Pilot feels confident “that we will be able to maintain supply to our stores despite low distillate inventory levels,” adding Pilot Company has a resilient supply chain with diverse capabilities “including global fuel sourcing and a vast trucking fleet that enable us to adapt and remain a reliable source of fuel. We are aware that domestic and global diesel inventory levels are lower than average due to a variety of factors and anticipate the U.S. distillate market could potentially see further tightening from September through November. Pilot Company is prepared to mobilize our resources accordingly to maintain a steady supply of fuel for our customers and guests.”

TravelCenters of America declined to comment for this story.

If there is a big fluctuation in diesel prices Kloza said it may take place between Thanksgiving and Valentine’s Day. If winter is cold, a lot of diesel molecules will go to the heating oil market. If it’s really cold, Kloza said, some utilities might turn to diesel for peak shaving needed for maximum power.

Diesel currently fetches “an epic premium,” Kloza said, of $50.67/bbl over WTI crude, so some of the bullish sentiment is baked in. If the winter is cold, Kloza said diesel could fetch $50-$100/bbl over the price of crude. “So don’t be lulled by the diesel cha-cha in the next 60 days,” he said. “It could set it up for a violent move come late November. The mismatch of crude for refiners (too much super-light, gasoline-rich crude) suggests lower prices for gasoline but higher prices for diesel.”

Implications for capacity contraction

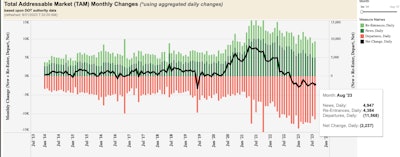

This chart shows the net change between carriers coming and going based on new and reactivated motor carrier authorities and revocations (the black line is the spread). These are just long-haul interstate carriers, with the exception the addition of California, Florida and Texas…

This chart shows the net change between carriers coming and going based on new and reactivated motor carrier authorities and revocations (the black line is the spread). These are just long-haul interstate carriers, with the exception the addition of California, Florida and Texas…