UK Growth Companies With High Insider Ownership June 2024

As the FTSE 100 shows signs of continued gains and the Bank of England’s policy decisions loom, the UK market remains a focal point for investors. In this context, growth companies with high insider ownership can offer unique advantages, potentially aligning management interests closely with shareholder outcomes in these evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

|

Name |

Insider Ownership |

Earnings Growth |

|

Plant Health Care (AIM:PHC) |

26.4% |

121.3% |

|

Petrofac (LSE:PFC) |

16.6% |

124.5% |

|

Getech Group (AIM:GTC) |

17.3% |

86.1% |

|

Gulf Keystone Petroleum (LSE:GKP) |

10.7% |

47.6% |

|

Integrated Diagnostics Holdings (LSE:IDHC) |

26.7% |

25.5% |

|

Foresight Group Holdings (LSE:FSG) |

31.7% |

30.9% |

|

Velocity Composites (AIM:VEL) |

28.5% |

143.4% |

|

TEAM (AIM:TEAM) |

25.8% |

58.6% |

|

Afentra (AIM:AET) |

38.3% |

64.4% |

|

Mothercare (AIM:MTC) |

15.1% |

41.2% |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Volex plc is a manufacturer and supplier of power products and cable assemblies, operating across North America, Europe, and Asia, with a market capitalization of approximately £634.45 million.

Operations: The firm operates across three key regions, generating revenue through the manufacture and supply of power products and cable assemblies.

Insider Ownership: 26.9%

Revenue Growth Forecast: 13.3% p.a.

Volex, a UK-based company, demonstrates promising growth with its earnings expected to expand by 20.16% annually, outpacing the UK market’s 13.1%. Recent corporate guidance highlighted a significant revenue jump to at least US$900 million for FY2024, up by over 25%, partly due to strategic acquisitions like Murat Ticaret. However, Volex faces challenges such as high debt levels and shareholder dilution over the past year, which could temper its appeal despite robust revenue and profit growth forecasts.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on the exploration, development, and production of hydrocarbons, with a market capitalization of approximately £1.89 billion.

Operations: The company generates its revenue primarily from the exploration and production of hydrocarbons, totaling approximately $1.42 billion.

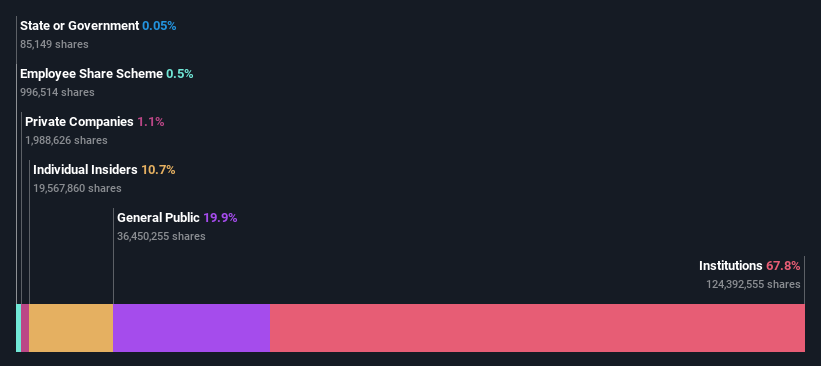

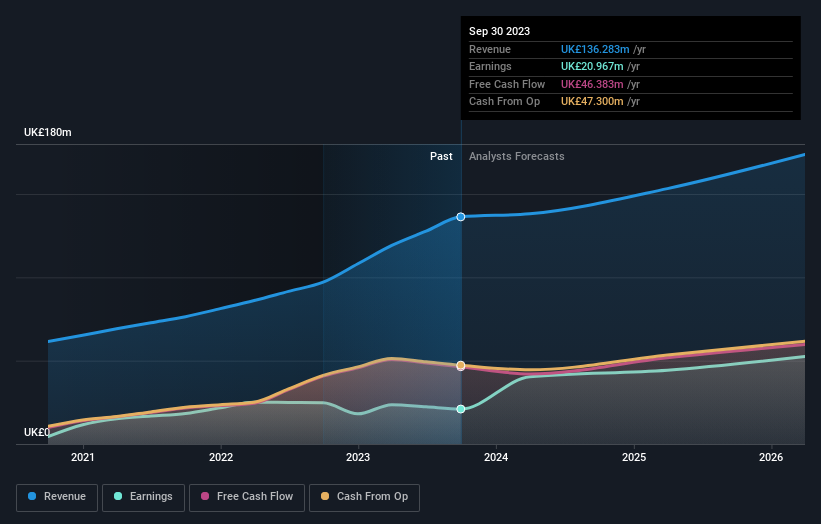

Insider Ownership: 10.7%

Revenue Growth Forecast: 12.6% p.a.

Energean, a UK-based growth company with high insider ownership, is trading 40.9% below its estimated fair value, suggesting potential undervaluation. Despite a substantial increase in production and recent positive earnings results—revenue doubling to US$1.42 billion and net income soaring to US$184.94 million—the company’s debt remains high. Analysts expect Energean’s earnings to grow by 19.42% annually, outpacing the UK market projection of 13.1%. However, its dividend coverage is weak, raising sustainability concerns.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity management firm operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £525.53 million.

Operations: The company generates revenue through three primary segments: Infrastructure (£85.68 million), Private Equity (£39.28 million), and Foresight Capital Management (£11.33 million).

Insider Ownership: 31.7%

Revenue Growth Forecast: 10% p.a.

Foresight Group Holdings, a UK growth company with high insider ownership, is currently trading 38.6% below its estimated fair value, indicating potential undervaluation. Analysts predict a significant rise in the stock price by 31%. The company’s earnings are expected to grow by 30.9% annually over the next three years, surpassing the UK market forecast of 13.1%. However, its dividend coverage is poor and profit margins have declined from last year’s levels.

Taking Advantage

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by…

Read More: UK Growth Companies With High Insider Ownership June 2024