The Unintended Consequences of Managing ESG Risks

Environmental, social, and governance strategies come in a variety of shapes and sizes. Some are tightly tied to their parent universe. Others intentionally incur more active risk, or larger differences from the market, in pursuit of stocks that better manage ESG risks. As the emphasis on managing ESG risks grows, so does the gap between an exchange-traded fund’s performance and that of its parent universe. That doesn’t always translate into better performance or less overall risk.

Is Being Different Good?

The types of ESG ETFs available to investors span a wide spectrum. At one end is iShares ESG Aware MSCI USA ETF ESGU, with a Morningstar Medalist Rating of Silver. It doesn’t stray too far from the broader U.S. market. By design, MSCI tries to keep the tracking error of its target index to within 0.50% of the U.S. large-cap market—a tight constraint that keeps ESGU in sync with U.S. stocks. And it has remained faithful to that restriction. The ETF’s tracking error relative to the MSCI USA, including fees and trading costs, landed at 0.66% over the five years through June 2023.

The other end of the spectrum features ETFs that crank up the active risk with a more-acute focus on the strongest ESG stocks. IShares MSCI Global Sustainable Development Goals ETF SDG intentionally pursues a select group of stocks that causes it to look very different from its parent universe, the MSCI ACWI. Its active risk, as measured by tracking error, landed at almost 9% relative to that benchmark over the same five-year period, or about 14 times that of ESGU.

Higher tracking error is baked into the process SDG uses to select stocks, and it’s picky. It only invests in companies that meet a set of minimum ESG standards and provide products or services that address one or more of the world’s social or environmental challenges, as defined by the United Nations’ Sustainable Development Goals. The initiatives it targets include alternative energy and energy efficiency, sustainable water and agriculture, and basic human needs like nutrition and sanitation.

Few companies meet those lofty standards, and SDG’s portfolio tends to hold around 100 to 150 of the 2,500 to 3,000 stocks in the MSCI ACWI. It usually shies away from stocks in the financials, communication services, and technology sectors, while favoring industrials and consumer staples.

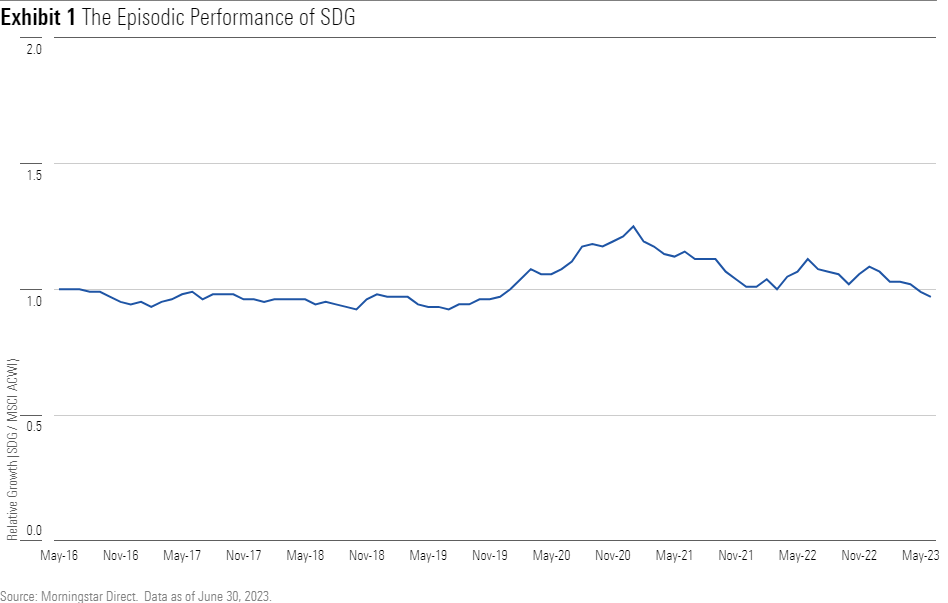

Those active bets had an immense impact on SDG’s performance, but in an odd way. Exhibit 1 shows the growth of one dollar invested in SDG at its inception relative to the MSCI ACWI, its parent universe. Upward sloping lines indicate SDG outperformed the MSCI ACWI, while downward sloping lines mean the opposite. A flat line indicates no advantage or disadvantage, such as the first three years of its track record. But it went on a tear in 2020, beating the MSCI ACWI by more than 28 percentage points for the year.

Tesla’s Short-Term Contribution

SDG’s stellar but brief outperformance in 2020 had little to do with its virtuous intention and is largely explained by one holding. Tesla TSLA instantly became SDG’s largest position when it purchased the electric car manufacturer’s shares in early 2019. The timing proved fortunate. Shares of Elon Musk’s company gained 743% in 2020, accounting for all of SDG’s excess return and more.

Tesla’s presence in this portfolio isn’t hard to fathom, as its electric vehicles should help lower greenhouse gas emissions. But beneath its environmentally conscious veneer lies a wildly speculative and risky investment. The company had just started generating profits in 2020, and its price multiples at the time defied gravity. SDG eventually punted Tesla from its portfolio in late 2021, likely because the company no longer measured up to its strict selection criteria.

SDG’s stake in Tesla highlights the disconnect between ESG intentionality and risk management. ETFs like SDG may push investors toward companies that better manage ESG risks or try to chart a more sustainable future. But valuation ratios, expected cash flows, and profitability—metrics with long-established connections to a stock’s future return—often sit on the bench. That opens the door for questionable, if not speculative, holdings to find their way in.

Revisionist History

Rewinding the tape and stripping Tesla from SDG’s portfolio paints a rather bleak picture. Exhibit 2 shows the growth of SDG’s portfolio without Tesla relative to the MSCI ACWI. The periods of outperformance were far less frequent and more muted in magnitude after removing the electric car company. Overall, the modified portfolio trailed its parent universe by approximately 2 percentage points per year from its launch in April 2016 through June 2023. Most of the downside occurred from March 2021 to…

Read More: The Unintended Consequences of Managing ESG Risks