Take Five – Gauging the Impact of the DOE’s Pause in LNG Export Licenses

There’s no doubt about it: The Biden administration’s decision to pause approval of LNG export licenses poses a new threat to a number of projects thought to be nearing a final investment decision (FID). The questions brought on by the move are profound: how big of a problem is this for U.S. developers, how does the timeout affect the projects now in limbo, and — over the longer term — what does the added uncertainty regarding incremental LNG exports mean for U.S. crude oil and natural gas production and what does it mean for the global energy landscape? In today’s RBN blog, we discuss the factors that led to the administration’s announcement — and the case to be made that expanded LNG exports are in the U.S.’s economic and strategic interest.

The U.S.’s mammoth reserves of natural gas, combined with strong global demand for LNG, have spurred a sharp rise in LNG export volumes over the past few years. As recently as December, an average of about 14 Bcf/d of LNG — or around 14% of the dry gas produced in the U.S. each day — is being liquefied and shipped overseas, almost all of it from export terminals along the Gulf Coast. And, with several new LNG export projects under construction, we expect those volumes to nearly double over the next four years.

As we said last spring in Life in the Fast Lane, the extraordinary growth in U.S. LNG export capacity has been facilitated by a mostly predictable federal permitting process. It may sometimes have been slower than developers would have liked, but LNG export projects that entered the federal permitting process with both the Federal Energy Regulatory Commission (FERC) and the Department of Energy (DOE) were generally granted their project authorizations and export licenses. And once they had them, they had been able to hold onto them via extensions — until lately, that is.

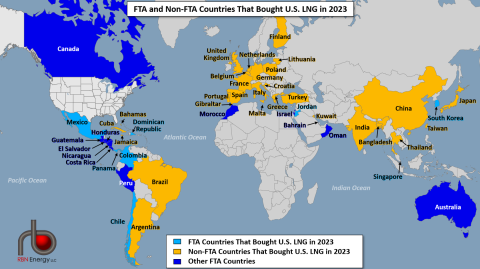

Before we delve into the Biden administration’s latest move, which may set back or even derail a number of multibillion-dollar LNG export projects on the drawing boards, we should provide a little background on the permitting and development process. Every project that plans to export U.S. natural gas as LNG — meaning not only projects in the U.S. but any project in Mexico or Canada that plans to source feedgas from the U.S. — requires an export license from the DOE. The export licenses come in two flavors, one for Free Trade Agreement (FTA) countries and one for non-Free Trade Agreement (non-FTA) countries, and typically allow for exports to continue through 2050. Projects need both licenses to export competitively — they are usually granted in that order (FTA first, then non-FTA) — and both typically come after a project has already received its FERC authorization. (Figure 1 shows the FTA and Non-FTA countries that imported U.S. LNG in 2023 — light-blue- and gold-shaded countries, respectively.)

Figure 1. FTA and Non-FTA Countries That Buy U.S. LNG. Source: RBN’s LNG Voyager

Read More: Take Five – Gauging the Impact of the DOE’s Pause in LNG Export Licenses