Stock Market Rally: How Long Will Bulls Win Over Bears? Strategists Give Views

When the stock market started to revive from the depths of the March lows, the killjoys were ready. It can’t last — just look at the state of the economy, they said. It’s going to crash again.

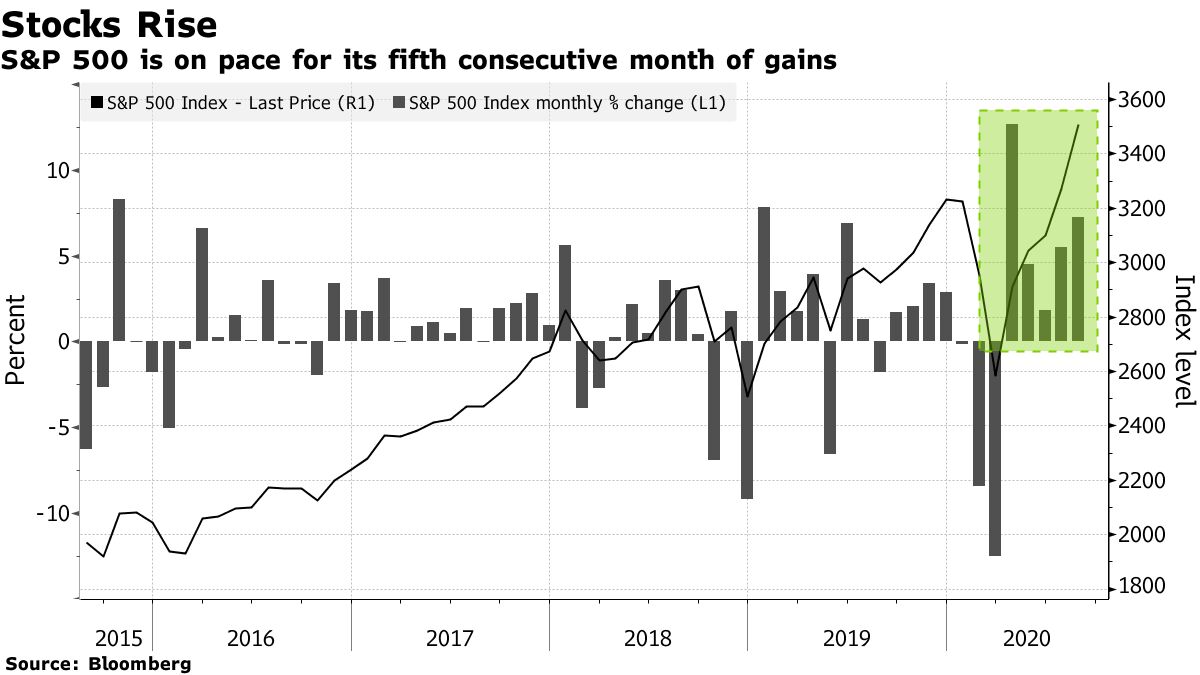

That message was repeated over and over even as the S&P 500 advanced more than 50% and added $10 trillion in value. Since surpassing its pre-Covid high last week, the index has notched records more than a half-dozen times.

The market’s relentless run has prompted many analysts to check what’s under the hood. Some now see evidence to justify further gains, citing everything from the Federal Reserve’s new policy goals to sidelined piles of cash that are ready to be deployed.

“I can’t see what’s going to change people’s perspective on why we should stop buying,” said Randy Frederick, vice president of trading and derivatives at Charles Schwab & Co. “If we continue to buy and we have a few more pullbacks, which I think is likely, people will just continue to jump in and buy those dips.”

In the wake of the S&P 500’s surge, a number of strategists have raised their forecast for where the index will end the year. Those at Goldman Sachs Group and RBC Capital Markets did so earlier this summer. On Friday, Brian Belski, chief investment strategist at BMO Capital Markets, reinstated his year-end S&P 500 target of 3,650. That represents a roughly 4% advance from current levels.

Read more: Stock Market at Record Forcing Everyone to Become Believer

Pointing to the resourcefulness of American companies and society’s ability to pivot, Belski wrote in a note that “U.S. stocks have exhibited an epic price recovery that not only is unprecedented but tests most major academic and common-sense assumptions.”

Many also cite the Fed’s interventions. Shawn Snyder, head of investment strategy at Citi Personal Wealth Management, says it seems unlikely the central bank would allow a large decline in stocks to happen.

“When investors believe that, it gives them excess confidence and they’re willing to take on more risk and buy stocks even though valuations are high,” he said in an interview. “There are several bears that have thrown in the towel.”

Rule of 72

To Keith Lerner at SunTrust Advisory Services, the move higher over the past few months has created a stretched market, but the buying pressure is reminiscent of what’s typically seen during the first stage of a bull market. Record prices shouldn’t be viewed as a concern, as history shows stocks tend to gain an additional 9.2% over the 12 months following a record high. And he said that an important transition is underway — earnings appear to again be a major contributor to the upward move.

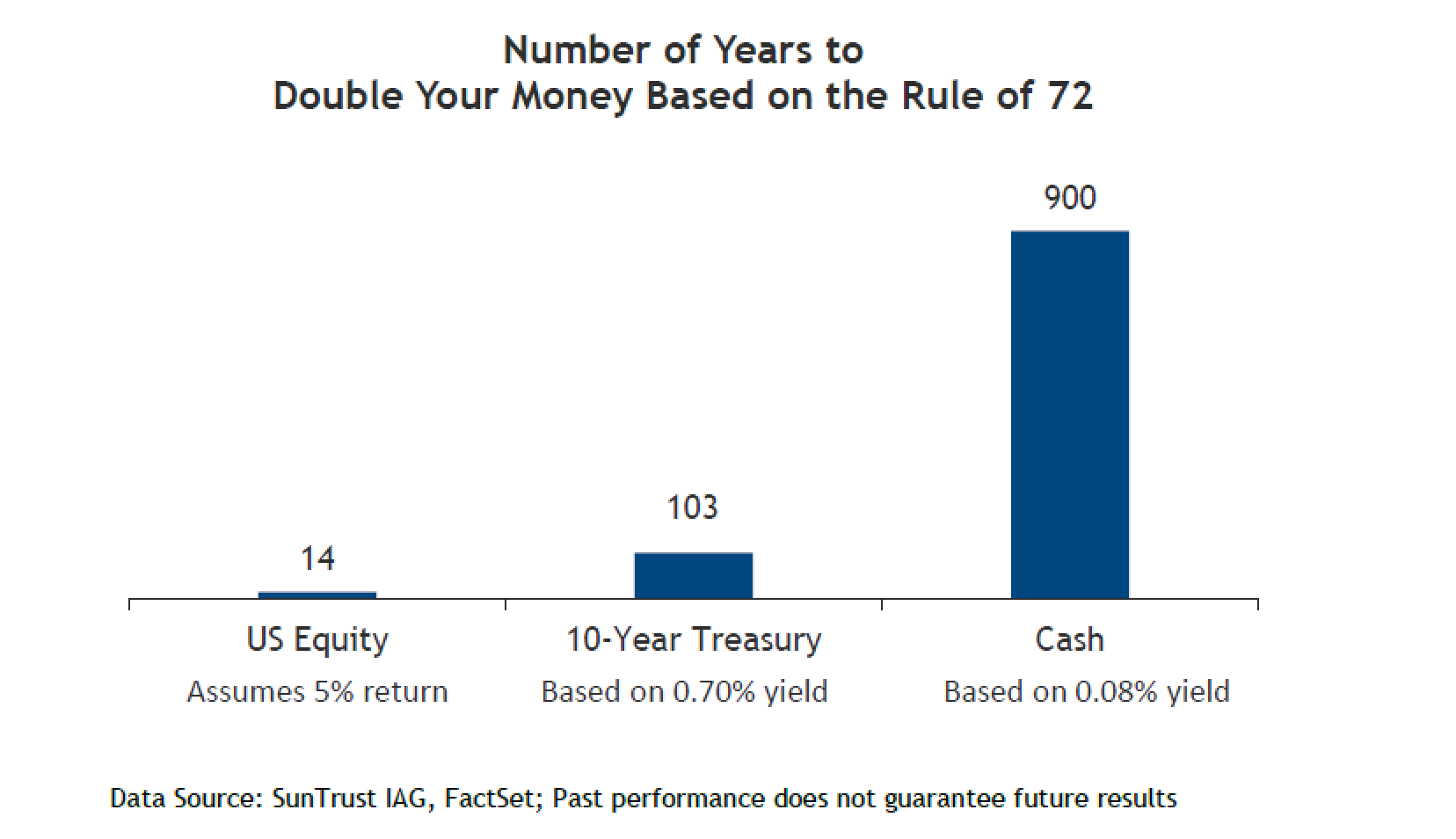

Lerner, who is SunTrust’s chief market strategist, says valuations might stay elevated given the lack of other attractive options to put money to work. He cites the Rule of 72, used to calculate how long it will take for an investment to double given a fixed annual rate of return. (Divide 72 by the assumed rate of return to estimate how many years doubling might take). Using a 5% annualized return, it takes about 14 years for equity investors to double their money. It takes more than 100 years for a 10-year Treasury investment to do the same and 900 years for cash.

“The weight of the evidence in our work still supports a positive longer-term market outlook,” Lerner wrote.

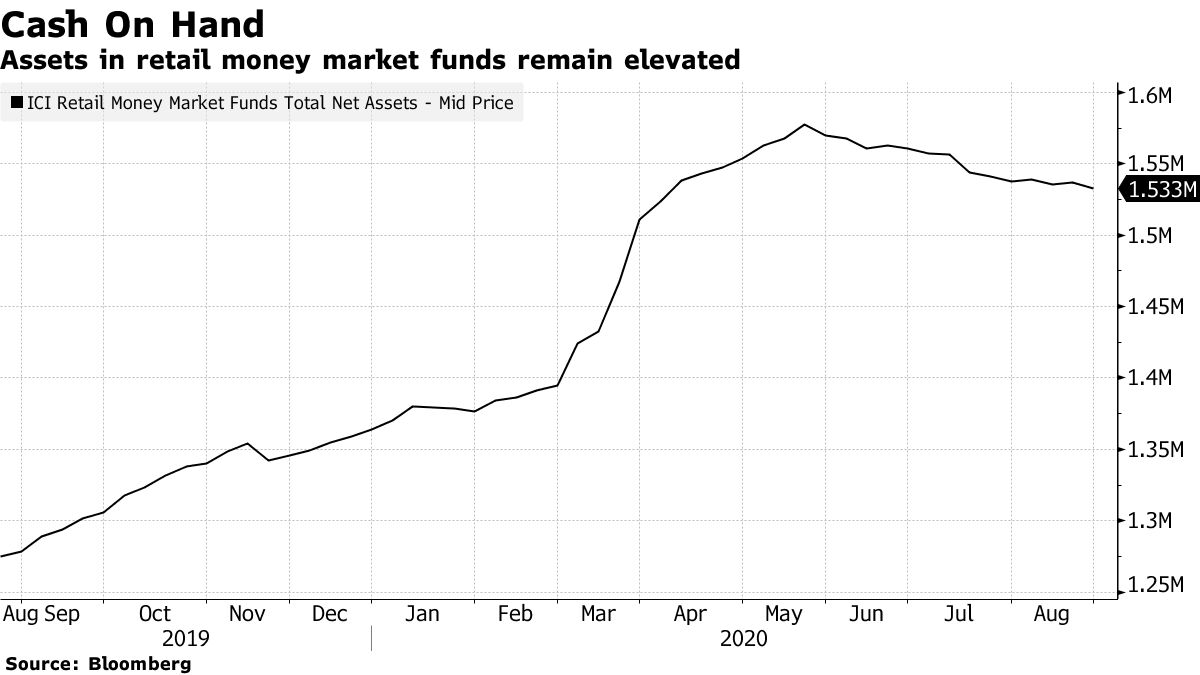

Negative real rates — which take inflation into account — make stocks, as well as certain other hard assets like homes, “particularly attractive” at a time when retail cash in money market funds is hovering near record levels, according to Evercore ISI strategist Dennis DeBusschere. Some of that money could find its way toward equities, he said.

Victoria Fernandez, chief market strategist for Crossmark Global Investments, says she wouldn’t be surprised to see a pullback before the end of the year, but overall, she expects the market to trend higher. In her view, breadth will strengthen, with sectors including consumer staples and financials joining the rally. Any possible positive news on Covid-19 will support stocks, and the Federal Reserve is extremely stimulative.

“You’ve got these really low rates,” Fernandez said. “That’s going to help drive the market.”

— With assistance by Lu Wang, and Claire Ballentine

Read More: Stock Market Rally: How Long Will Bulls Win Over Bears? Strategists Give Views