SPYI ETF: JEPI Fans Take Note. There’s a New High-Yield Competitor in Town

The JPMorgan Equity Premium Income ETF’s (NYSEARCA:JEPI) combination of high yield and monthly payments has quickly made it one of the market’s most popular ETFs. Investors who like JEPI’s style now have another high-yield competitor to consider — the NEOS S&P 500 High Income ETF (BATS:SPYI), which also pays on a monthly basis and yields 10.7%. Let’s take a closer look at this intriguing new option for high-yield investors.

What is SPYI ETF’s Strategy?

Launched in August of 2022, SPYI is still a relatively small ETF from NEOS with just $218 million in assets under management (AUM) that employs a similar strategy to the much larger JEPI.

NEOS says that SPYI “seeks to generate high monthly income in a tax efficient manner with the potential for equity appreciation in rising markets.” NEOS essentially seeks to fully replicate the S&P 500 (SPX) and generates its high yield by receiving the dividend payments from its S&P 500 holdings, and then adds to this yield with the distributions generated by its selling of S&P 500 covered call options, which generates a premium.

NEOS also touts that the SPYI ETF is tax-efficient in that it uses “SPX index options classified as section 1256 contracts (60% long term/40% short term).”

Lastly, NEOS also highlights the fact that its strategy may lead to lower volatility in a “mildly bullish or mildly bearish environment.”

Is There a Tradeoff?

This strategy certainly helps to juice yield, but as with anything in life, there is always a tradeoff. While SPYI mentions the potential for equity appreciation in rising markets, selling covered calls caps this upside at a certain point because if the price of the underlying stock rises beyond the strike price, that’s additional upside that SPYI investors miss out on.

You can see this play out in real time with the results of SPYI, JEPI, and other similar ETFs. So far, SPYI has generated a great 17% return year to date (as of the end of the most recent month), but the broader market (represented here by the Vanguard S&P 500 ETF (NYSEARCA:VOO) was actually up an even better 20.6% over the same time frame. Similarly, JEPI also trails VOO with a return of 7.3% year-to-date.

SPYI is less than a year old, so it’s hard to judge how its strategy will perform over time. However, using JEPI as a reasonable proxy for it, this strategy has also trailed the market over a three-year time frame with a total return of 11.5% versus a 13.7% return for VOO.

JEPI is fairly new itself, but using another “S&P 500 covered call ETF” to look at this strategy over time for comparison’s sake, we can see that the Global X S&P 500 Covered Call ETF (NYSEARCA:XYLD) has trailed VOO over the past five and 10 years, with total annualized returns of 4.7% over the past five years and 7.0% over the past 10 years versus far superior returns of 12.2% and 12.6% over the past five and 10 years, respectively, for VOO.

None of this is to say that SPYI is a bad ETF or that covered-call ETFs are bad, and these are still pretty solid returns, but it simply illustrates the fact that they have historically tended to leave upside on the table versus simply investing in the broader market.

SPYI’s Holdings

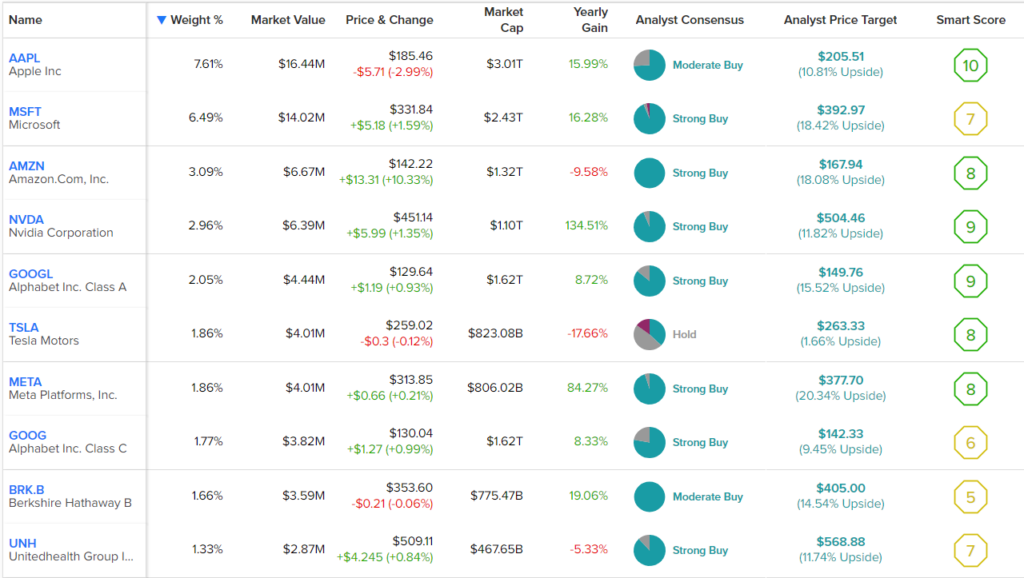

SPYI offers investors ample diversification. It holds 506 stocks, and its top 10 holdings account for 30.7% of its assets. Below, you can take a look at SPYI’s top 10 holdings using TipRanks’ holdings tool.

Because SPYI invests in the S&P 500, its holdings are fairly similar to that of the S&P 500 index itself. Apple (NASDAQ:AAPL) is the fund’s largest holding with a 7.6% weighting, followed by the other ‘magnificent seven’ tech stocks that have led the market to new heights in 2023 — Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Tesla (NASDAQ:TSLA), and Meta Platforms (NASDAQ:META).

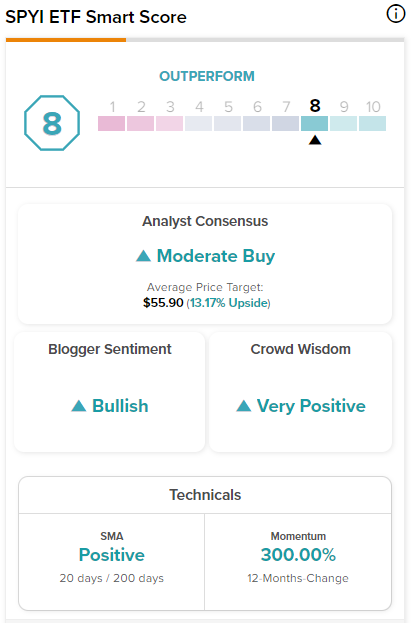

Overall, this is a very strong group of holdings with some great Smart Scores to boot. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. As you can see, six of SPYI’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above. SPYI itself boasts a strong ETF Smart Score of 8.

Is SPYI Stock a Buy, According to Analysts?

Turning to Wall Street, SPYI has a Moderate Buy consensus rating, as 59.08% of analyst ratings are Buys, 35.42% are Holds, and 5.5% are Sells. At $55.90, the average SPYI stock price target implies 13.2% upside potential.

SPYI Has High Fees

One…

Read More: SPYI ETF: JEPI Fans Take Note. There’s a New High-Yield Competitor in Town