Seven mistakes you could be making while engaging with your financial planner

In a recent survey conducted by ET Wealth, financial planners conceded that the individuals who came to them for advice, disrupt the process in a myriad ways. Behavioural tics, wilful misrepresentation, and selective implementation are some ways in which they dilute the sanctity of financial planning. These habits and attitudes not only end up compromising the value of the advice, but importantly, prove costly for the clients in the long run. For no fault of the adviser, the client could fall short of the funds needed for a goal, or worse, fail to achieve them. If you expect the planner to make the right moves on your behalf, you must also participate wholeheartedly. Harsh Roongta, Founder, Fee Only Financial Planners LLP, insists, “When a patient consults a doctor, it is only with his full cooperation that the prescribed course of medicine can work. It is no different in an adviser-client relationship.” In this story, we bring out the common missteps and mistakes that clients make while engaging with planners. We hope it will help you unlock the true potential of your relationship with your adviser.

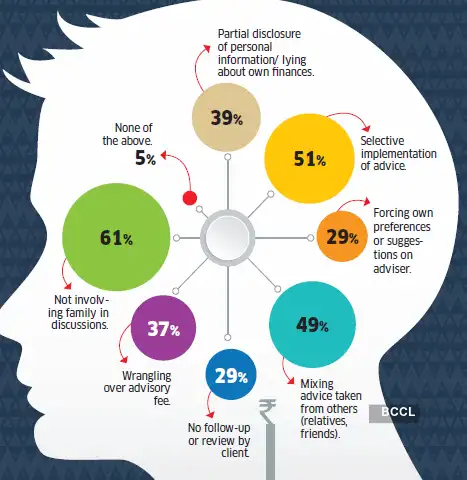

Q. What are the issues you face while engaging with clients?

Not involving the family in discussions and selective implementation of advice by clients are among the biggest concerns for financial planners.

Note: The survey was conducted among 41 financial planners. Figures are % of respondents. Figures do not add up to 100%.

Reveal all financial details to your planner

Incomplete information will lead to a flawed plan, causing problems later.

Financial planners point out that clients often suppress certain aspects of their finances. So, for instance, they may not reveal the existence of certain assets, such as a residential flat or a plot of land, to the adviser. This may be out of fear that the adviser will ask them to dispose of the asset. At times, individuals are not entirely forthcoming about personal circumstances, say, a special needs child at home, fractious relationship between husband and wife, or the need for home care for aged parents.

Note:Ranked on a scale of 1 to 5 (1 is lowest and 5 is highest)Suresh Sadagopan, Founder, Ladder7 Wealth Planners, laments, “People think we can help only in the financial area and fail to show us the entire picture about their personal lives, which can have an implication on their finances. We come to know about some of these things later on, when the engagement increases, and modify our advice on getting clarity.”

By not disclosing these aspects, you are essentially leaving your adviser with a blind spot. For the planner to offer you the right antidote for your specific problems, he needs to have a complete picture of your current finances and personal circumstances. Make sure you put all your cards on the table. Don’t hesitate to divulge any relevant information during initial discussions with the adviser.

Don’t force your biases on the adviser

Impulsive decisions and emotional moves can derail the financial plan.

Tackling the inherent biases and perceptions of clients is part of the job description for any financial adviser. Some individuals come with unrealistic expectations. Often, financial planners are questioned about not targeting higher return on investments. Managing return expectations in a runaway bull market is particularly tricky, say advisers. “Some investors have only seen a one-way uptick in the stock market without the reality check of a long, painful correction. Their return expectations are very high,” points out Nishant Batra, Chief Goal Planner, Holistic Wealth. Sadagopan nods, “We are sometimes accused of being far too conservative in our return estimates.”

Many of us also have set notions about spending on vacations, buying property or even kids’ foreign studies and destination weddings. Advisers make sure to give a realistic assessment of the situation. The onus is on the adviser to check the worst impulses of the client. “During discussions, objections are made clear on taking big deviations,” insists Dev Ashish, Founder, StableInvestor. However, planners concede that it is ultimately the client’s money. Some accommodation for the client’s suggestions and expectations cannot be avoided. As long as the financial calculations are not being blown apart,…

Read More: Seven mistakes you could be making while engaging with your financial planner