Russia exploits billion-dollar oil cap loophole

Receive free War in Ukraine updates

We’ll send you a myFT Daily Digest email rounding up the latest War in Ukraine news every morning.

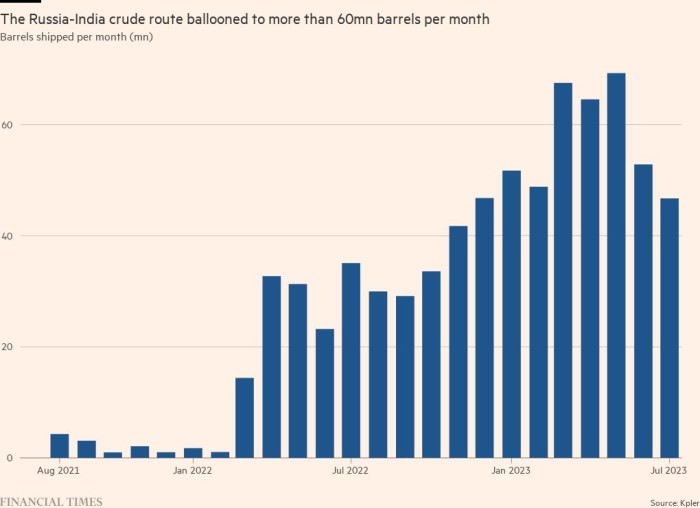

Inflated shipping costs are enabling Russian companies to earn far more from crude oil sales to India than previously recognised, according to a Financial Times analysis which suggests that the charges may have raised more than $1bn in a single quarter.

Russia has, until recently, appeared to comply on this route with western measures designed to curb its revenues which were introduced after its full-scale invasion of Ukraine last year. Its oil producers have been selling crude to India for below the $60-per-barrel price cap.

But when freight costs are included, they and the traders with whom they work have charged much higher sums.

An FT analysis of ships running directly from Russia’s Baltic ports to India suggests that this overcharging, combined with fees earned from shipping the oil on Russia-linked vessels, may have been worth $1.2bn in the three months to July.

Benjamin Hilgenstock, an academic at the Kyiv School of Economics, which has been studying evasion of the price cap, said: “Inflated shipping costs are a major concern as they effectively create a leak in the price cap regime through which someone, somewhere can siphon off billions of dollars.”

James Cleverly, the UK’s foreign secretary, said: “It comes as no surprise that Putin is becoming increasingly desperate and dishonest in his attempts to mitigate the price cap’s impact — something that has been severely restricting Russian revenues since its introduction. Those aiding Russia’s attempts to fund this illegal war should know, the UK will continue to act alongside our partners to enforce this measure.”

The price cap imposed by the G7 is intended to keep Russian oil flowing while squeezing revenues that could be used to fund the war. But the cap — which places requirements on buyers, shipowners and insurers from participating countries — does not impose any limit on freight costs.

Customs records issued in Russia from December until the end of June indicate that the average price of crude oil shipped to India was around $50 per barrel in Russia’s Baltic ports. This kept the sales in line with the cap, which applies to the so-called “free on board” (FOB) price, or the cost of the oil at the port of loading.

But Indian customs data shows that the prices actually being paid in India after delivery — the so-called “cost, insurance and freight” (CIF) price — over the same period had amounted to $68. This was a marked discount on world oil prices, which averaged around $79 per barrel over the period, but implies an $18 per barrel rise in prices between the Baltic and India.

Figures from Argus, a pricing agency, also point to a large spread. Argus estimates that the average price of Urals crude has been $14.90 per barrel higher in India than in the Baltic since data started to be collected in February. This is in excess of Argus’s estimates of the actual price of shipping, which has averaged around $9 per barrel.

An official at an Indian state-owned oil company which bought some of this oil told the FT that Indian buyers were buying inclusive of shipping costs. The official said that no negotiation was allowed over freight arrangements or costs.

The excess charges are therefore likely to have been captured by the sellers of the oil. According to Kpler, the data analytics company, the oil producers Lukoil and Rosneft have made direct sales to Indian refineries. In other cases, the sale is managed by trading companies that have emerged in the past year with close links to several Russian oil companies.

Kpler estimates that Russia shipped 108mn barrels from the Baltic to India from May to July in 134 vessels, a time when the spread between Argus prices averaged $17 per barrel, after taking account of the lag between departure and delivery. At that time, Argus estimates that commercial shipping rates averaged $9 per barrel, suggesting that the overcharging may be worth around $800mn.

Hilgenstock said: “If Russian oil companies and traders agree to these kind of contractual conditions, we have to assume that a portion of the spread is being captured by Russia — whether or not Russia owns the tankers moving the oil.”

Russia does have a hand in the…