Rio Tinto Seems To Be Primed For Very Good H2 2020 Financial Results (NYSE:RIO)

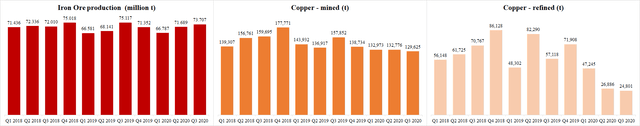

Rio Tinto (RIO) released its Q3 2020 operational results. What is positive, its main segments (iron ore, copper, and aluminium) are doing well, especially given the current complex COVID-19-related situation. Moreover, the metals prices improved notably during Q3. This all indicates that Rio Tinto is primed for very good H2 2020 financial results.

The copper production did slightly worse, as the volume of copper mined at Rio Tinto’s mines declined by 2.4%, to 129,625 tonnes (285.774 million lb). This was the lowest quarterly copper production volume recorded over the last three years. The decline is attributable especially to the Kennecott operations, where the lower copper feed grades resulted in a 5% copper production decline compared to Q2 and even 40% decline compared to Q3 2019. At Escondida and Oyu Tolgoi, the copper production remained in line with Q2. The volume of refined copper remains low, as the major maintenance of the Kennecott refinery took longer than expected and the impacts of the anti-pandemic measures were still felt at Escondida.

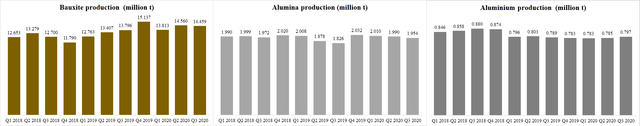

The Q3 bauxite production of 14.459 million tonnes was in line with 14.56 million tonnes produced in Q2. However, compared to Q3 2020, bauxite production increased by 4.8%. The alumina production of 1.954 million tonnes was only slightly lower compared to Q2 and 7% higher compared to Q3 2019. Aluminium production grew by 1.5% compared to Q2 and by 1% compared to Q3 2020. Rio Tinto reported that its Betancourt facility operated nearly at full capacity, while the Iceland and New Zealand facilities operated at 85% and 90% of their capacities respectively. Rio Tinto is also trying to negotiate lower energy costs in New Zealand and Iceland, in order to improve the economics of the operations.

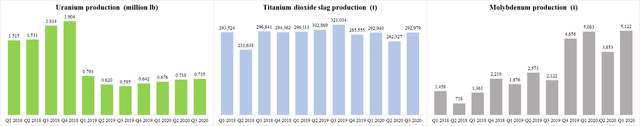

The uranium production increased to 735,000 lb. It is 2.4% more than in Q2 and even 26% more than in Q3 2019. However, Rio Tinto’s only uranium-producing operation, the Ranger mine, controlled via an 86.33% equity interest in Energy Resources of Australia (OTCPK:EGRAF), processes only stockpiles. It should cease uranium production by January 2021.

Rio Tinto’s titanium dioxide slag production increased by 11.7%, to 292,979 tonnes. It means an 11.7% improvement compared to the previous quarter. However, compared to Q3 2019, the numbers are 8.7% lower. On the other hand, molybdenum production climbed up to 5,122 tonnes (11.292 million lb) which is 33% more than in Q2 and 141% more than in Q3 2019. The majority of this growth was caused by the fact that at the Kennecott operations, the molybdenum head grades increased by 36%, and molybdenum recoveries increased by 39%.

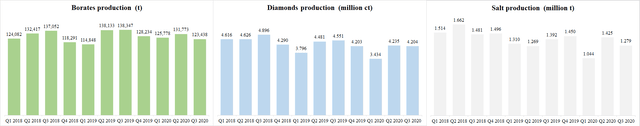

The production of borates declined by 6.3% quarter-over-quarter and by 10.8% year-over-year. Rio Tinto reduced production due to low demand. The diamond production remained flat, at 4.2 million ct. But compared to Q3 2019, it declined by 7.6%. And a further decline is coming, as the Argyle mine should be closed next year. In Q3, it was responsible for 76% of Rio Tinto’s diamond production. The salt production declined to 1.279 million tonnes, or by 10.2% compared to Q2 and by 8.1% compared to Q3 2019.

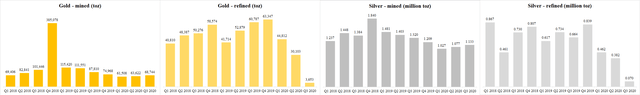

Rio Tinto’s gold production grew by 8% in Q3, to 68,744 toz. However, the volume of refined gold declined rapidly, to 3,653 toz. The reason is the major maintenance at the Kennecott refinery. The maintenance impacted also the refined silver volumes that declined to 70,000 toz. On the other hand, the volume of mined silver grew to 1.133 million toz, which is 5.2% more than in Q2.

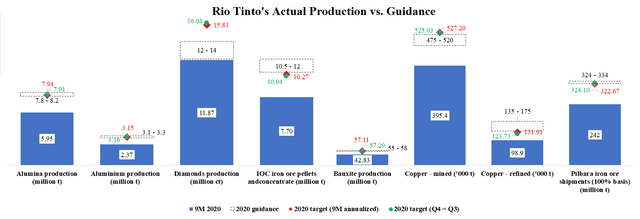

It looks like Rio Tinto should be able to meet its 2020 production guidance for the majority of its main products. The chart below shows the 9M 2020 production, the 2020 production guidance intervals, and two alternatives of 2020 production targets. The first one is based on annualizing the actual 9M production and the second one is based on the assumption that the Q4 production will equal the Q3 production.

As can…

Read More: Rio Tinto Seems To Be Primed For Very Good H2 2020 Financial Results (NYSE:RIO)