Opinion | Brics has a better way to de-dollarise than creating a single currency

De-dollarisation is the process of reducing reliance on the dollar as a reserve currency, a medium of exchange or a unit of account in the global economy. Aside from the enormous implications this has for global financial markets and international trade, given the dominance of the United States in the global economic system, it also has important political implications.

Some countries seek to de-dollarise to diversify their central bank reserves – that is, by reducing their reliance on the dollar, they could in theory manage more efficiently their currency risks and maintain greater control over their monetary policy. Yet others may have political motivations; for instance, by diminishing the dollar’s influence on their economies, they can reduce their dependence on US policies.

But whatever the form, experts agree that a common currency would be difficult to achieve given the disparities between all five Brics members, including in economics and politics.

Is the idea of a common Brics digital currency feasible? It is, but it would face many challenges. In 2019, Brics nations discussed the possibility of a digital token and plans have been revised with the rise of de-dollarisation efforts. But to do so, the bloc would need to set up a banking union and a fiscal union, and also achieve macroeconomic convergence.

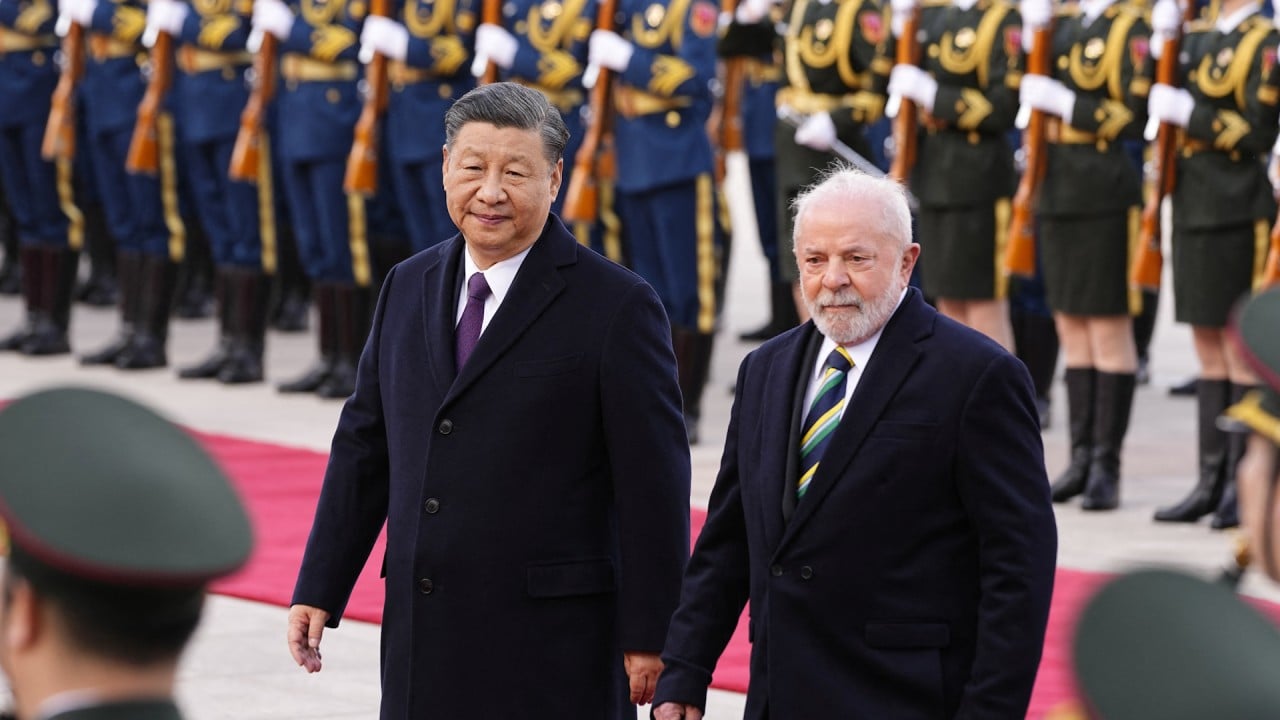

Furthermore, a single Brics currency would leave the bloc dominated by its biggest and most powerful economy, which is China. This leaves some of us to wonder why smaller countries would want to link their monetary policy and aspects of their fiscal policy to the Chinese economy.

To me, the more feasible idea would be for each Brics country to launch, for example, its own central bank digital currency and then work towards interoperability.

As most countries of the world have yet to launch their own central bank digital currency, the interoperability issue, it would seem, is mainly one for the future. Still, there is a vital role here that Hong Kong can play.

Read More: Opinion | Brics has a better way to de-dollarise than creating a single currency