Mortgage blow as repayments rise by £400 amid ‘surging interest rates’

New homebuyers should expect to pay around £400 more per for their mortgage than they would have five years ago, according to new research.

Analysis from Rightmove suggests that the average person trying to get on the property ladder for the first-time buyers has seen their repayments rise by 61 per cent in the last five years.

Since the last General Election year in 2019, homeowners have seen their mortgage payments jump from £667 to £1,075 a month on average.

These calculations are made on various assumptions, including that first-time buyers would have a 20 per cent deposit to put down on a home.

Furthermore, the analysis is based on the situation that their mortgage term would last 25 years and that they were taking out a five-year fixed-rate mortgage on an average interest rate.

On top of this, the property website used used average asking prices of a typical first-time buyer homes, with two bedrooms or fewer, for the research.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Homeowners have struggled with rising mortgage repayments as a consequence of high interest rates PEXELS

Homeowners have struggled with rising mortgage repayments as a consequence of high interest rates PEXELSNationally, first-time buyers are currently having to pay an average amount of £227,757 for a new house, which has risen by around 2019 per cent since the Conservative Party secured a large majority under Prime Minister Boris Johnson in 2019.

In the North-West of England, first-time buyers have witnessed asking prices jump by a third over this period.

Comparatively, London first-time buyers have seen the smallest percentage rise in the last five years of only six per cent.

It should be noted that house prices in London are notoriously higher than elsewhere in the UK with Rightmove’s data suggest the average home costs £500,000.

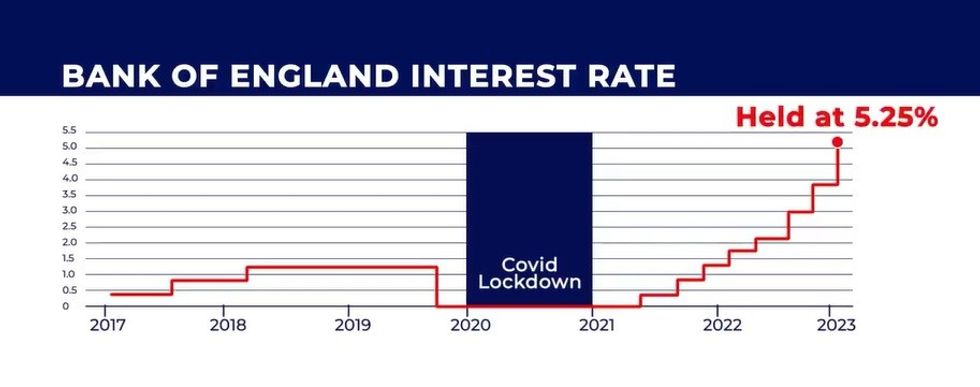

Last week, the Bank of England’s Monetary Policy Committee (MPC) voted to keep the country’s base rate at 5.25 per cent.

This is despite the fact the consumer prices index (CPI) inflation for the 12 months to May 2024 eased to two per cent, which is the Bank’s desired target.

Analysts are pricing in a potential cut to interest rates in the later half of the year which could see mortgage repayments drop for millions down the line.

Tim Bannister, Rightmove’s property expert, said: “As rates have increased over the last five years, the amount that a typical first-time buyer is paying each month on a mortgage has outstripped the pace of earning growth.

“Some first-time buyers are looking at extending their mortgage terms to 30 or 35 years to lower monthly payments, or looking at cheaper homes for sale so that they need to borrow less.

“If mortgage rates reduce, this will help first-time buyers in the short-term more so than election housing promises.

LATEST DEVELOPMENTS:

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August GB NEWS

“We hope that the next Government can support first-time buyers with well thought out policies, which address the difficulties of saving up a large enough deposit and being able to borrow enough from a lender.”

Nathan Emerson, chief executive at Propertymark, added: “Surging interest rates and inflation over the last few years have impacted the housing market with force.

“However, with the next General Election now under two weeks away, Propertymark is keen to see targeted support for first-time buyers at the first opportunity from any incoming government.”

The Bank of England will next make an interest rate announcement on August 1,…

Read More: Mortgage blow as repayments rise by £400 amid ‘surging interest rates’