KEY EQUITY THEMES FOR 2024

To Learn More, Be Sure to Visit – oceancityfinancialgroup.com

Jeffrey Buchbinder, CFA, Chief Equity Strategist

Adam Turnquist, CMT, Chief Technical Strategist

Following the Federal Reserve’s (Fed) aggressive rate-hiking campaign in 2022 and 2023, stocks are entering a phase in which the market narrative is focused on interest-rate stability — as inflation, we believe, comes down further. Low and stable interest rates should help support stock valuations, while corporate profits are moving into a sweet spot. So even though stocks look fully valued, if rates ease as we expect, we could see upside to our year-end 2024 fair-value target range of 4,850 to 4,950. We highlight some key themes for stocks next year.

MORE SUPPORTIVE ECONOMIC ENVIRONMENT

If 2023 was the year of stubbornly high inflation and rate hikes, perhaps 2024 could be the year of significant progress toward the Fed’s 2% inflation target and rate cuts.

This economic cycle has been unique and difficult to predict due to post-pandemic distortions. Importantly, though, even if we get a mild, short-lived recession in the first half of 2024 (far from assured), a second-half 2024 economic recovery should support stocks. We believe the bear market in 2022 and accompanying cost cuts from corporate America (particularly in technology areas) prepared markets for a slowdown, which should help mitigate equity market downside. And don’t forget, the inflation and rate surge that sparked recession fears is far less of a worry today.

So, while the uncertainty that comes with anticipating a recession may limit stock gains in early 2024, it could bolster investor sentiment midyear, as is typical coming out of an economic trough (the lowest part and turning point of an economic cycle). Bottom line, we anticipate a stock- market-friendly macroeconomic environment in 2024, and one in which bonds may also perform quite well.

THIS BULL MARKET IS STILL YOUNG

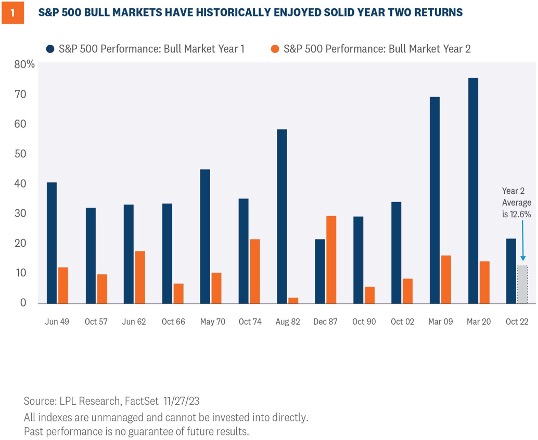

History doesn’t always repeat, but it rhymes. As the next 12 months of the bull market get underway, kicking off year two of this bull market born in late 2022, market history tells us solid gains may lie ahead. Of the 12 such second year bull market periods since 1950, the S&P 500 has gained an average of 12.6% and was positive every time (Figure 1).

Also, consider year one of this bull brought an underwhelming 21.6% gain in the S&P 500 compared to the more than 40% historical average for a first-year bull, leaving some additional upside even after a more than 20% advance in 2023.

The technical backdrop for U.S. equity markets continues to improve. The S&P 500 has staged an impressive comeback after briefly entering a correction period this fall. Broad-based buying pressure outside of just the mega-cap space likely has underpinned the recovery. The cyclical or offensive tilt in market leadership and building momentum in this rally provide additional technical evidence for a sustainable bull market in 2024 characterized by broader participation.

STOCK-BOND CORRELATION MAY BECOME OUR FRIEND

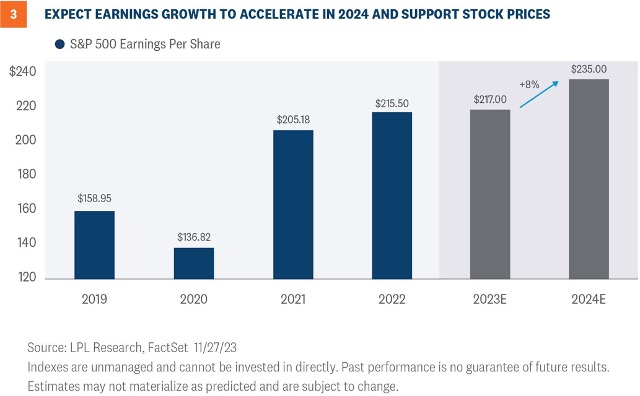

With inflation still somewhat elevated, we cannot completely discount the possibility of renewed upward pressure on interest rates. However, if inflation moves down near the Fed’s target over the course of 2024 as we expect, stocks should benefit.

Stocks and bond yields became increasingly negatively correlated (moving in opposite directions) in 2023 (Figure 2), which could present an opportunity for stocks and bonds in 2024. LPL Research expects the 10-year Treasury yield to end 2024 between 3.75% and 4.25%, with potential downside if the U.S. economy slows more than economists currently anticipate.

EARNINGS ENTERING A SWEET SPOT

EARNINGS ENTERING A SWEET SPOT

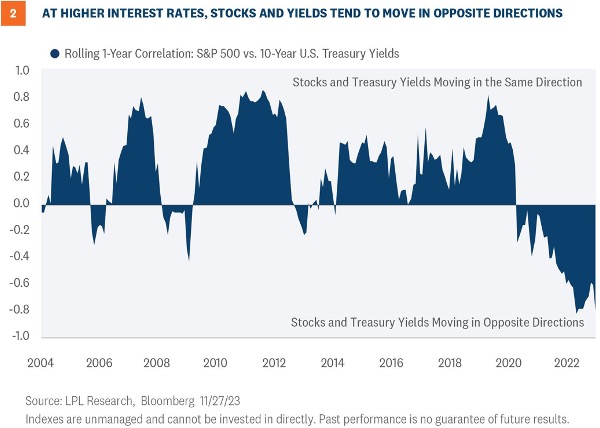

Earnings are exiting a recession and entering a period of growth. But the much better-than- expected bottom-line results from corporate America in 2023 — clearly beneficiaries of the surprisingly resilient U.S. economy — have raised the bar for 2024.

Still, modest economic growth in 2024, in our view, will be sufficient to drive earnings growth in 2024, even if the economy contracts at some point during the year and as long as inflation continues to fall. Our 2024 S&P 500 earnings per share (EPS) forecast is $235 per share, about 7% above the current 2023 consensus S&P 500 EPS estimate of $219 and 8% above LPL Research’s $217 forecast (the long-term historical average earnings growth rate is about 8%, Figure 3).

Read More: KEY EQUITY THEMES FOR 2024

EARNINGS ENTERING A SWEET SPOT

EARNINGS ENTERING A SWEET SPOT