Judges Scientific And Two More UK Growth Companies With High Insider Ownership

As the United Kingdom approaches a pivotal general election, financial markets remain under scrutiny, with recent discussions focusing on regulatory actions and electoral outcomes. In this context, exploring growth companies with high insider ownership can offer investors a unique perspective on commitment and confidence within these businesses amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

|

Name |

Insider Ownership |

Earnings Growth |

|

Gulf Keystone Petroleum (LSE:GKP) |

10.8% |

47.6% |

|

Plant Health Care (AIM:PHC) |

30.7% |

121.3% |

|

Petrofac (LSE:PFC) |

16.6% |

124.5% |

|

Integrated Diagnostics Holdings (LSE:IDHC) |

26.7% |

25.5% |

|

LSL Property Services (LSE:LSL) |

10.8% |

33.3% |

|

Directa Plus (AIM:DCTA) |

14.1% |

102.5% |

|

Velocity Composites (AIM:VEL) |

27.8% |

143.4% |

|

Belluscura (AIM:BELL) |

39.1% |

124.1% |

|

Afentra (AIM:AET) |

37.2% |

64.4% |

|

Mothercare (AIM:MTC) |

15.1% |

41.2% |

Let’s review some notable picks from our screened stocks.

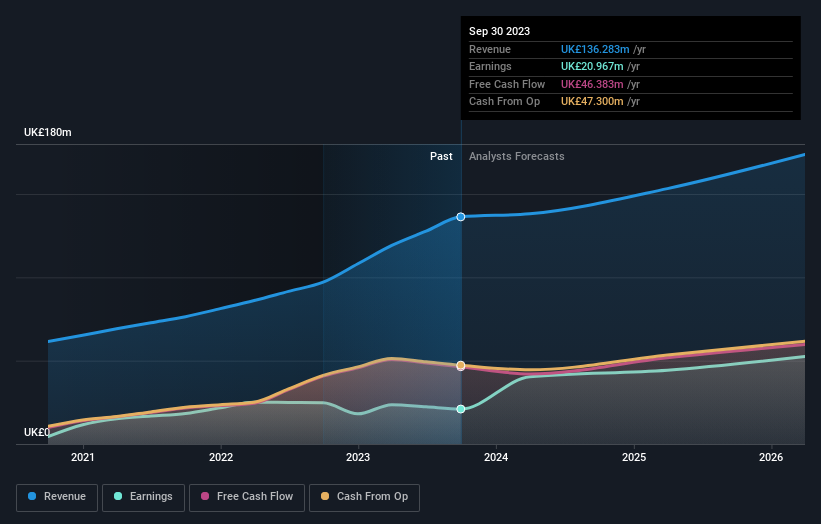

Simply Wall St Growth Rating: ★★★★★☆

Overview: Judges Scientific plc is a company that designs, manufactures, and sells scientific instruments, with a market capitalization of approximately £677.42 million.

Operations: The company generates its revenue primarily from two segments: Vacuum, which contributes £63.60 million, and Materials Sciences, contributing £72.50 million.

Insider Ownership: 11.5%

Earnings Growth Forecast: 25.3% p.a.

Judges Scientific, a UK-based company, demonstrates robust growth prospects with an expected earnings increase of 25.32% annually, outpacing the UK market forecast of 12.5%. Despite slower revenue growth at 4.8% yearly compared to some high-growth benchmarks, it remains above the UK market average of 3.5%. Insider activity shows more buying than selling in recent months, highlighting confidence from within despite a backdrop of substantial one-off items impacting financial results and a high debt level. Recent corporate actions include significant dividend increases and bylaw amendments to streamline governance.

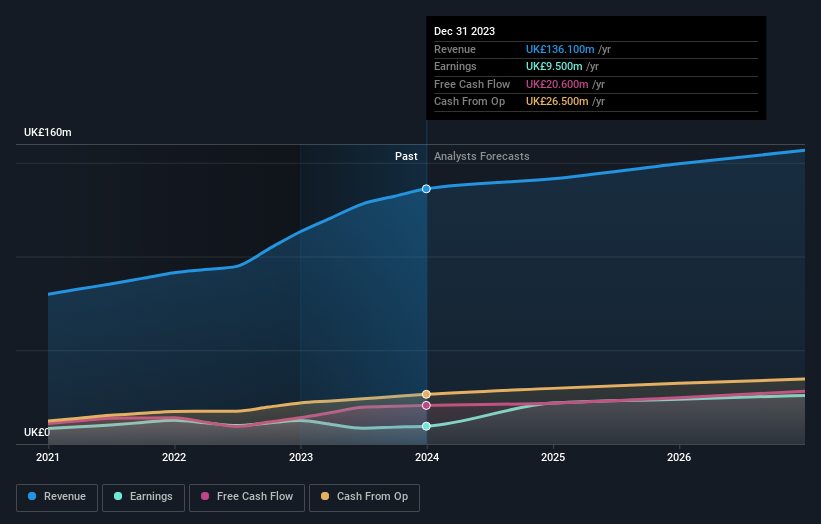

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is a company that manages infrastructure and private equity in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia, with a market capitalization of approximately £551.31 million.

Operations: The company generates revenue through three primary segments: Infrastructure (£84.17 million), Private Equity (£47.35 million), and Foresight Capital Management (£9.80 million).

Insider Ownership: 31.8%

Earnings Growth Forecast: 31.6% p.a.

Foresight Group Holdings, a UK-based firm, has shown promising growth with a revenue increase to £141.33 million and net income rising to £26.43 million year-on-year. The company’s earnings are expected to grow by 31.63% annually over the next three years, significantly outpacing the UK market forecast of 12.5%. Despite this robust profit growth, its dividend coverage is weak, with recent dividends not well covered by earnings. Recent activities include consistent dividend payments and a completed share buyback program for £0.97 million.

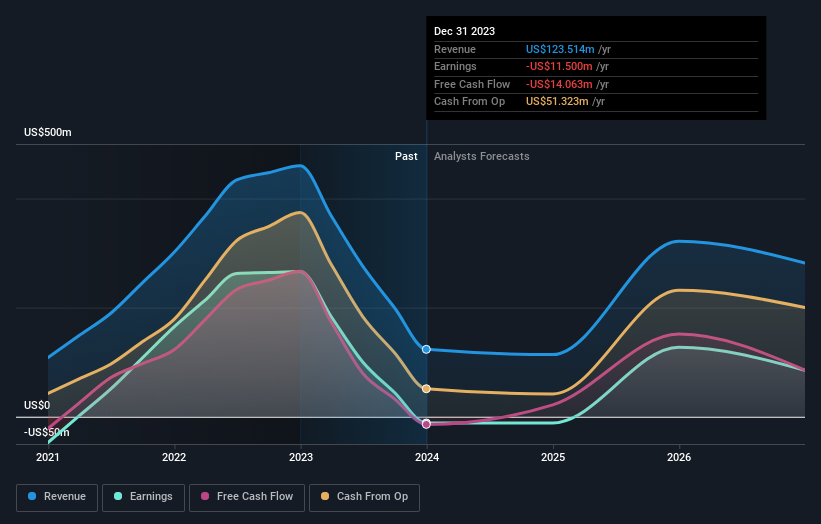

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is an oil and gas exploration, development, and production company operating in the Kurdistan Region of Iraq, with a market capitalization of approximately £325.40 million.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling approximately $123.51 million.

Insider Ownership: 10.8%

Earnings Growth Forecast: 47.6% p.a.

Gulf Keystone Petroleum, a UK-based oil and gas company, is trading at 56.9% below its estimated fair value with expected substantial revenue growth at 25.1% per year, outpacing the UK market’s average of 3.5%. Despite its highly volatile share price recently, it forecasts strong profitability within three years and anticipates a high return on equity of 31.8%. Recent actions include initiating a $10 million share buyback program to reduce capital, underscoring confidence in future performance despite no significant insider buying or selling reported in the past three months.

Make It Happen

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial…

Read More: Judges Scientific And Two More UK Growth Companies With High Insider Ownership