High Insider Ownership Growth Companies On The German Exchange June 2024

Amidst a backdrop of political uncertainty and fluctuating market conditions across Europe, the German stock exchange has not been immune to recent downturns, reflecting broader concerns that have affected investor sentiment. In such an environment, examining growth companies with high insider ownership might offer valuable insights, as these firms often demonstrate a commitment from those most familiar with their strategic direction and potential.

Top 10 Growth Companies With High Insider Ownership In Germany

|

Name |

Insider Ownership |

Earnings Growth |

|

pferdewetten.de (XTRA:EMH) |

26.8% |

75.4% |

|

Deutsche Beteiligungs (XTRA:DBAN) |

35.4% |

31.6% |

|

YOC (XTRA:YOC) |

24.8% |

22.2% |

|

NAGA Group (XTRA:N4G) |

14.1% |

58.1% |

|

Exasol (XTRA:EXL) |

25.3% |

107.4% |

|

Alelion Energy Systems (DB:2FZ) |

37.4% |

106.6% |

|

elumeo (XTRA:ELB) |

25.8% |

99.1% |

|

Redcare Pharmacy (XTRA:RDC) |

17.7% |

46.9% |

|

Your Family Entertainment (DB:RTV) |

17.5% |

116.8% |

|

Friedrich Vorwerk Group (XTRA:VH2) |

18% |

30.4% |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

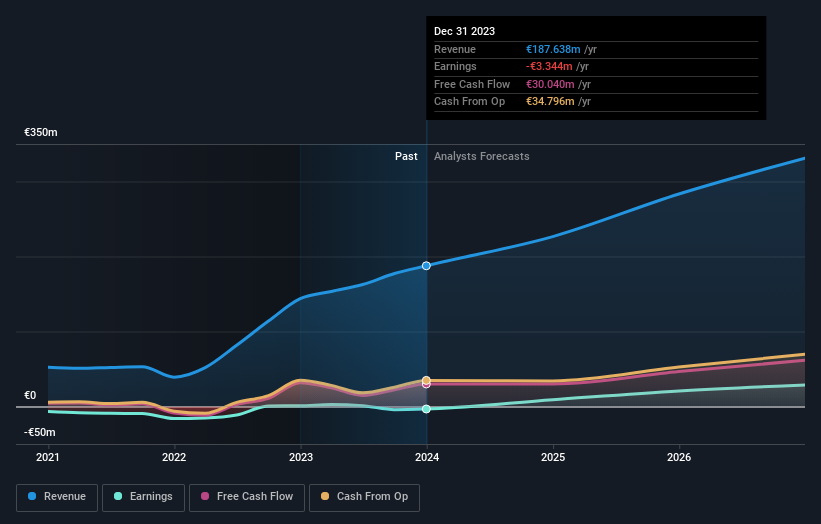

Overview: Brockhaus Technologies AG operates as a private equity firm and has a market capitalization of approximately €334.33 million.

Operations: Brockhaus Technologies generates revenue primarily through its Security Technologies and Financial Technologies segments, totaling €39.43 million and €153.43 million respectively.

Insider Ownership: 26.6%

Brockhaus Technologies, a growth-oriented company in Germany, reported increased year-over-year sales and revenue for both the latest quarter and full year, despite shifting from a net income to a net loss. The company is optimistic about future growth, projecting substantial revenue increases for 2024. Additionally, Brockhaus has initiated its first dividend and completed a significant share buyback program. While insider trading remains static, the forecasted return to profitability within three years alongside expected revenue growth positions Brockhaus as an intriguing entity with high insider ownership but facing challenges in achieving consistent profitability.

Simply Wall St Growth Rating: ★★★★★☆

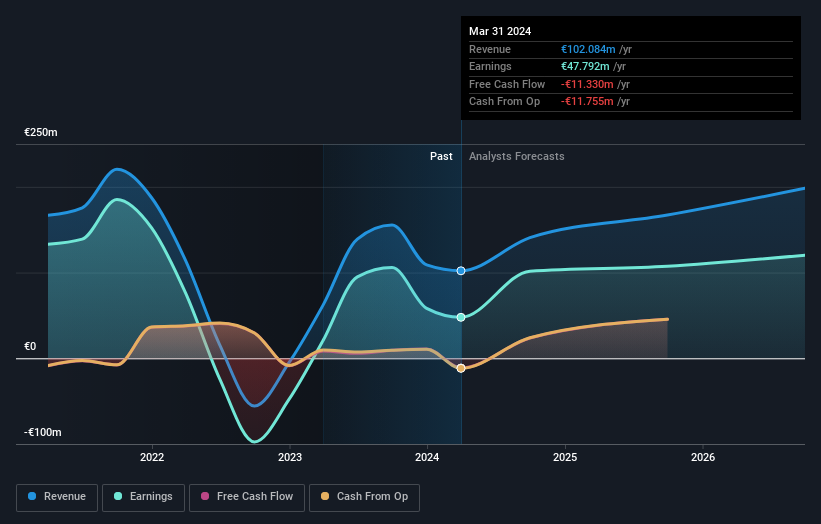

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm that focuses on direct and fund of fund investments, with a market capitalization of approximately €525.02 million.

Operations: The company generates revenue primarily through two segments: Fund Investment Services and Private Equity Investments, with earnings of €47.85 million and €55.15 million respectively.

Insider Ownership: 35.4%

Deutsche Beteiligungs AG, a German growth company, is expected to see its earnings grow by 31.6% annually, outpacing the local market’s 18.6%. Despite this robust profit outlook and a recent share buyback initiative valued at €25 million starting May 17, 2024, concerns linger as its dividend coverage by cash flows remains weak. Additionally, while revenue forecasts are strong at an annual increase of 24.7%, the company’s return on equity is projected to be modest at 17.5% in three years.

Simply Wall St Growth Rating: ★★★★☆☆

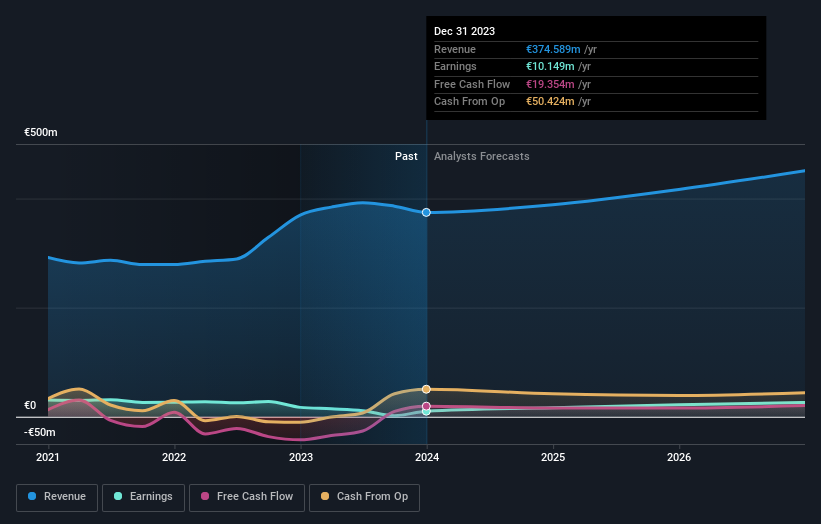

Overview: Friedrich Vorwerk Group SE specializes in offering solutions for the transformation and transportation of energy across Germany and Europe, with a market capitalization of approximately €0.37 billion.

Operations: The company generates revenue through segments focused on electricity (€72.07 million), natural gas (€157.60 million), clean hydrogen (€28.59 million), and adjacent opportunities (€118.73 million).

Insider Ownership: 18%

Friedrich Vorwerk Group SE, a German company with significant insider ownership, demonstrated solid financial performance in its recent quarterly report with sales and net income showing noticeable improvement from the previous year. Despite this growth, the annual figures revealed a drop in net income compared to the prior year. The company maintains a consistent dividend policy, reinforcing shareholder returns amidst varying earnings. No substantial insider selling has been reported in the past three months, indicating continued confidence by insiders in the firm’s trajectory.

Where To Now?

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you…

Read More: High Insider Ownership Growth Companies On The German Exchange June 2024