Hawkish Fed Spooks Precious Metal Traders

Via AG Metal Miner

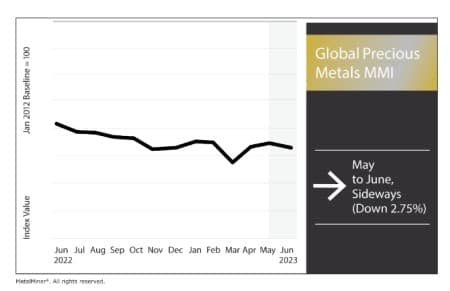

The Global Precious Metals MMI (Monthly Metals Index) traded sideways month-on-month. Overall, the index fell 2.75% as numerous components lost upward price momentum. All parts of the index moved sideways or fell slightly, except for Indian silver ingots and U.S. gold bullions. Though Fed’s hawkishness has managed to impact precious metal prices in the U.S, prices still maintain some long-term bullish sentiment thanks to high inflation. That said, inflation also appears to be slowing down.

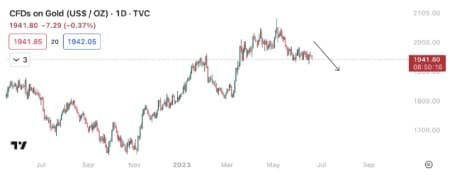

Gold Losing Strength in the Short-Term

Price action for gold is beginning to show a slowdown in terms of bullish strength. Indeed, gold prices recently fell just under 2,000/oz once again. Therefore, it is safe to say precious metals prices (namely gold and silver) are beginning to pull back into support zones.

Precious Metal Prices: Silver

As with gold, the silver price rally continues to slow down. At the beginning of the month, prices began to pull back into demand zones. This could help drive prices once the index establishes support.

Precious Metal Prices: Palladium

Palladium prices continue to show range trading, with a slight decline. There are no signals of bullish anticipation, considering the index continues to demonstrate zero bullish price action patterns.

Platinum Remains Within a Sideways Range

Prices for platinum markets appear rather similar to gold prices. Specifically, there is a pull back driving platinum into support zones while bullish strength continues to slow down. Prices will need a breakout to the upside to establish an uptrend once again.

By the Metal Miner Team

More Top Reads From Oilprice.com:

Read More: Hawkish Fed Spooks Precious Metal Traders