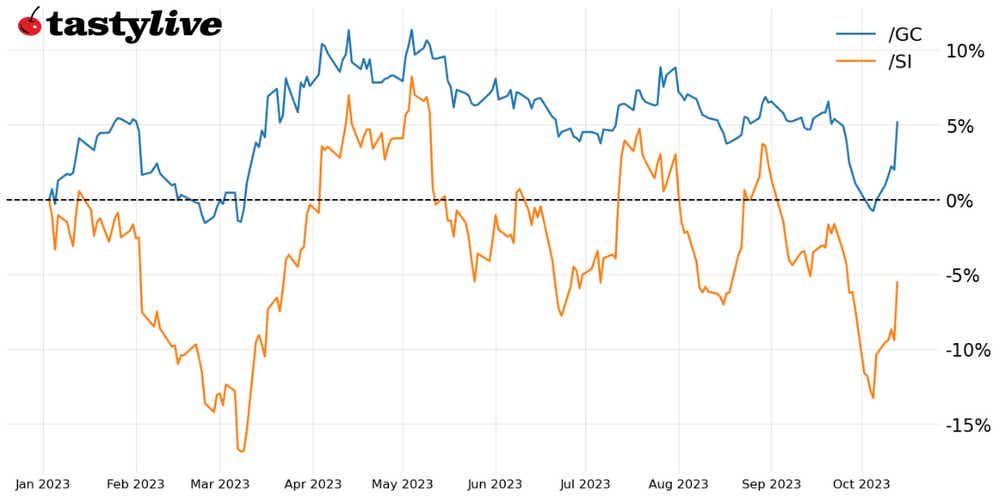

Gold prices surge and momentum continues to improve in silver

Gold prices up 3.11% month-to-date

- Gold and silver prices have surged at the onset of the Israel-Hamas war.

- U.S. Treasury yields turning lower amid safe haven demand for bonds are a tailwind for precious metals.

- Clear signs from Federal Reserve officials that the rate hike cycle is finished are helping as well.

On Tuesday, we argued that “Federal Reserve officials have hinted that the rise in yields means that no more rate hikes are needed.” This refrain has continued over the course of the week, with five separate Fed officials–Raphael Bostic, CEO of the Atlanta Fed; Mary C. Daly, CEO of the San Francisco Fed; Lorie K. Logan, CEO of the Dallas Fed; Patrick T. Harker, CEO of the Philadelphia Fed; and Fed governor Philip N. Jefferson–each suggesting that the hike cycle is finished.

The breakdown in U.S. Treasury bonds has been halted, partly, due to this shift in tone. And with U.S. inflation expectations turning higher in recent days, U.S. real yields (nominal Treasury yields less inflation expectations) have dropped back from multi-decade highs. This is a fundamentally more supportive environment for gold and silver.

Impact of the Israeli-Hamas war

The bigger catalyst, however, may be the ratcheting higher of geopolitical event risk over the week. The Israeli-Hamas war is still in its crescendo. Risk of a sprawling conflict with other regional actors may be curtailed now, but news of the Israeli-Saudi peace pact putting on hold offers little confidence ahead of what could be a sad, very bloody weekend.

Gold and silver have thus reclaimed their role as geopolitical safe havens while yields are less of an impediment–a perfect storm akin to what was seen in February 2022 at the onset of Russian’s invasion of Ukraine. The gains this week have been so significant, in fact, that technical evidence is now quickly stacking up of not only a major low having been formed, but the downtrend seen since July ending altogether.

/GC gold price technical analysis: daily chart (September 2022 to October 2023)

Gold prices (/GCZ3) have surged over +3% in Friday’s session, and the weekly candlestick setup now highlights a morning star candlestick cluster, a three-candle pattern that beckons a low have been formed. The move on Friday has carried /GCZ3 back to the declining trendline from the July and late-September swing highs in the process.

Momentum continues to improve, evidenced by the advance higher in moving average convergence/divergence (MACD) towards its signal line and slow stochastics closing in on overbought territory. Clearing the trendline near 1940 would set up a return to the late-September swing high near 1970.

/SI silver price technical analysis: daily chart (September 2022 to October 2023)

Earlier this week it was noted that “the drop below 22.60 in late-September led to a flush in silver prices, but /SIZ3 never cleared out its March lows. In the process, a double bottom around 21 may have begun to form clearing 22.60 would be the surest technical signal that a significant bottom has been formed.” /SIZ3 was last quoted at 22.895 when this article was written.

The return to a level above 22.60–near the 50% Fibonacci retracement of the September 2022 low/May 2023 high range, which served as support from June through September – suggests that a major bottom did indeed form last week. Momentum continues to improve, with /SIZ3 poised to close above its daily 21-EMA (one-month moving average) for the first time since Sept. 22. Attention now turns to the daily outside engulfing bar high formed Sept. 29 at 23.805.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Read More: Gold prices surge and momentum continues to improve in silver