EnLink Midstream: This 12% Yielder Is Looking Attractive (NYSE:ENLC)

On Wednesday, November 6, 2020, diversified Texan midstream company EnLink Midstream, LLC (ENLC) announced its third quarter 2020 earnings results. The midstream sector has been quite plagued by the ongoing effects of the COVID-19 pandemic and EnLink Midstream’s recent performance in the market has certainly reflected this. The market did appear to be reasonably impressed with these results, though, as it sent the company’s common unit price skyrocketing in the trading session following the results. This performance was in spite of the fact that EnLink Midstream failed to meet the revenue expectations of its analysts on the top-line, but it did beat their earnings estimate. Despite the strong performance over the past day or so, the company’s common unit price does remain in the low single digits, which is quite frequently a sign that the market has lost faith in the company. Therefore, let us take a look and see if its fears are justified.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from EnLink Midstream’s third quarter 2020 earnings results:

- EnLink Midstream reported total revenues of $928.5 million in the third quarter of 2020. This represents a 34.06% decline over the $1.4080 billion that the company brought in during the prior-year quarter.

- The company reported gross operating expenses of $379.0 million in the current quarter. This represents a 7.22% decline over the $408.5 million that the company reported in the year-ago quarter.

- EnLink Midstream’s gathering & transportation operation handled an average of 923.400 billion BTU of natural gas per day in the most recent quarter. This represents a substantial 22.89% increase over the 751.400 billion BTU of natural gas per day that the unit averaged last year.

- The company reported reported a distributable cash flow of $177.7 million in the reporting quarter. This represents a 5.65% increase over the $168.2 million that it reported in the equivalent quarter of last year.

- EnLink Midstream reported a net income of $39.2 million in the third quarter of 2020. This compares rather favorably to the $37.5 million net income that the company reported in the third quarter of 2019.

One thing that we have been seeing from a lot of midstream companies over the past few quarters is that their financial results were generally worse than what they reported a year ago. That was due to the direct effects of the pandemic, which reduced the demand for refined products and caused both crude oil production and prices to fall. We can see this in EnLink Midstream’s results, although the company has surprisingly held up reasonably well. As we can see above, the company’s revenue and gross margin (analogous to gross profit) both declined year over year, but most other measures of financial performance actually improved.

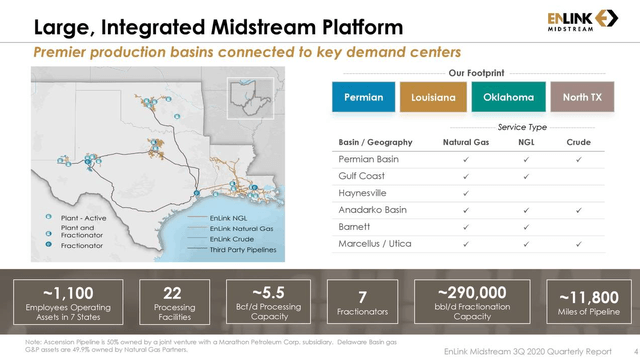

One of the reasons for the weakness in revenues and gross margins was that the company’s volumes of transported resources were generally lower than in the prior-year quarter. This was largely expected due to the regions that the company operates in. As briefly mentioned in the introduction, EnLink Midstream primarily operates in Texas, although it also has infrastructure in Oklahoma and Louisiana:

Source: EnLink Midstream

These are generally considered to be among the most resource-rich basins in the United States. The Permian basin in particular has been at the heart of the North American energy boom over the past decade. Unfortunately, this also creates some problems for EnLink as a result of the current much lower crude oil prices. This has caused many operators in the region to cut back on their drilling & completions activity in order to conserve capital. This is partly because of the fact that the world is currently oversupplied with crude oil and the fact that it is very expensive to produce in North America’s shale plays, as I explained in an earlier article. This has made it overall more attractive in many cases to keep the oil in the ground than produce it. The fact that less crude oil is being produced in the Permian and other basins means that there is less need for companies like EnLink to transport it away.

It is perhaps surprising then that EnLink Midstream saw its volumes of gathered and processed natural gas increase year over year. In fact, this was one of the only areas in which the company did see its volumes increase over the period. The reason that it is surprising is that the Permian basin is generally targeted for crude oil….

Read More: EnLink Midstream: This 12% Yielder Is Looking Attractive (NYSE:ENLC)