Diamond Hill Core Bond Fund Q2 2023 Market Commentary (DHRAX)

Kameleon007

Market Commentary

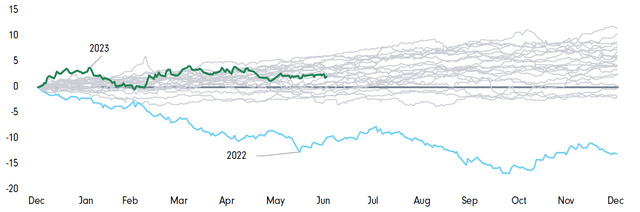

After back-to-back quarters of positive returns, the Bloomberg US Aggregate Bond Index slipped back into the red losing -0.84% in Q2. Despite the drop, the index remains well ahead of 2022’s year-to-date performance over the comparable period, +2.09% compared to a loss of -10.35%. Exhibit 1 is an illustration of the index’s performance since the turn of the century for comparison purposes.

Exhibit 1 – Bloomberg US Aggregate Bond Index, Year to Date (%)

Fading of the Regional Bank Crisis

We’re quite a bit removed from the final days of Q1 when failing regional banks were dominating the headlines on a regular basis. But let us not forget that Q2 began while concerns were still swirling around the viability of First Republic (OTCPK:FRCB) and other regional banks. In fact, the First Republic issue wasn’t resolved until early May, when JPMorgan (JPM) acquired most of its assets.

By the end of the quarter, the financial markets had stabilized, and we learned that all 23 of the US banks that were subjected to the Federal Reserve’s annual stress test weathered the severe recession scenario while continuing to lend to consumers and corporations. The banks were able to maintain minimum capital levels, despite $541 billion in projected losses for the group, while continuing to provide credit to the economy in the hypothetical recession. This year’s simulation included unemployment surging to 10%, a 40% decline in commercial real estate values, and a 38% drop in housing prices. It should be noted that the stress testing is focused on the largest banks and superregionals and does not include smaller banks, which were the cause of the angst in Q1, so the “all clear” that the test usually delivers was less than reassuring.

Federal Reserve Battles On

The labor market continued to prove resilient, with an additional 253,000, 339,000, and 209,000 jobs added in April, May, and June, respectively, pushing the average monthly job gain since the beginning of 2023 to 310,000 and over the past 12 months to 335,000.

With the strength in the labor market, the Federal Reserve continues to focus its efforts on inflation. The Fed hiked 25 basis points (bps) in May before hitting the pause button in June. But June’s meeting was a combination of dovishness (rate pause) and hawkishness (Statement of Economic Projections or SEP illustrated an additional two rate hikes by year-end, an increase from the previous SEP), leaving the door open to more uncertainty in the coming months.

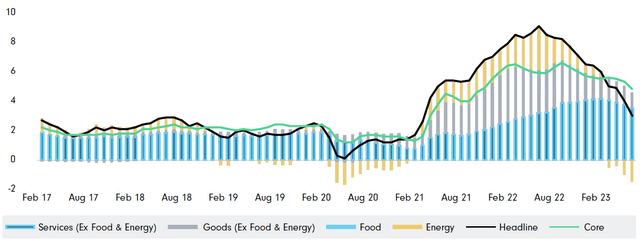

As of June 30, the market was on board with a rate hike in July, pricing in an 81% chance of a 25-bps hike at the July 26 meeting, compared to expectations for a cut at that meeting at the beginning of the quarter. With June’s CPI report showing that inflation is slowing down, having climbed only 3% from a year earlier, we may see the market and the Fed meet in the middle with one rate hike in July and then a prolonged pause as we head into the end of the year. The 3% increase over the past 12 months marks the slowest pace of increases in more than two years and harkens back to the pre-transitory period.

Exhibit 2 – Ongoing Inflation Battle Succeeding (%)

Deal Ceiling Resolution, Kicking the Can Down the Road Once More

The frighteningly traditional game of financial chicken between political parties came to a head at the end of May as President Biden and House Speaker Kevin McCarthy reached an eleventh-hour agreement to suspend the debt ceiling through the end of 2024.

At the beginning of the month, when negotiations appeared to be going nowhere, yields on T-bills maturing around the expected X-date (early June) were trading with a 7-handle, illustrating the extra compensation demanded by investors to hold the bills most likely to be the cause of default.

The deal was passed by the House and the Senate in the first days of June, which Biden signed into law, once more avoiding the financial catastrophe that would be brought on by a US government default. The rating agencies remained on the sidelines for the most part, though Fitch announced that the US will remain on “negative watch” despite the debt ceiling agreement. Once more, the US has succeeded in kicking the can down the road, with the next showdown coming in 2025.

Portfolio Performance & Positioning

Uncertainty around the debt ceiling and the final days of the regional bank crisis, combined with the Fed’s proclamation that it was not, in fact, done with rate hikes led to a challenging quarter for fixed-income markets. While it was nothing compared to the first three quarters of 2022 where the Bloomberg US Aggregate Bond Index lost -14.61%, the index was down -0.84% in Q2 after two strong quarters.

The worst-performing sector in the index was…

Read More: Diamond Hill Core Bond Fund Q2 2023 Market Commentary (DHRAX)