Covid shadow: Sharp dip in banks’ share in equity funds, tech & pharma surge

With rising concerns over the impact of Covid-19 pandemic on asset quality of banks following the end of the moratorium period, the banking sector has seen a sharp reduction in asset allocation by mutual funds over the last seven months.

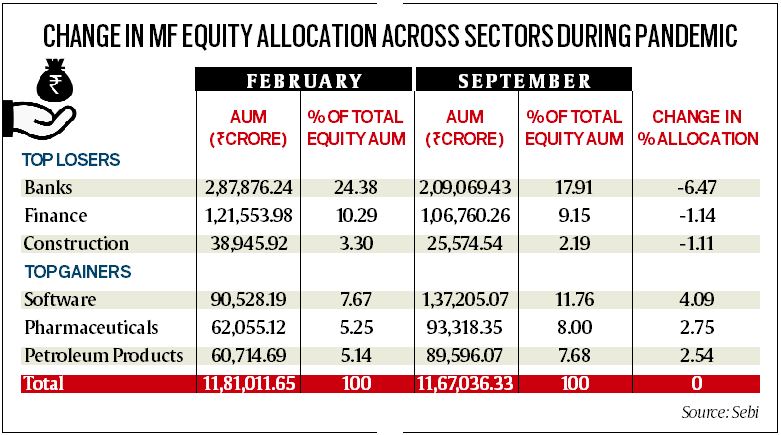

While the banking sector’s share in equity Assets Under Management (AUM) of MFs declined from 24.4 per cent in February to 17.9 per cent in September, sectors such as IT, pharmaceuticals and petroleum have seen an increase in their share.

Securities and Exchange Board of India (SEBI) data shows that the equity AUM of mutual funds in September reached Rs 11.67 lakh crore, marginally down from 11.81 lakh crore seen in February 2020.

However, equity fund allocation in banks in September stood at its lowest over the last seven months at 17.91 per cent or Rs 2,09,069 crore. The value of allocation in banks in February stood at Rs 2,87,876 crore.

Besides the banking sector, even the finance segment saw its share of MF equity allocation decline from 10.29 per cent to 9.15 per cent in the same period.

Concerns and opportunity

Fears over rising NPAs at the end of the moratorium forced fund managers to gloss over bank stocks over the last five months. But with the banking index trailing in the recovery phase, experts see fresh opportunity for investors.

By contrast, in the same period, the share of equity allocation from the IT sector jumped from 7.67 per cent in February to 11.76 per cent. Pharma, too, has been a big gainer as it saw its share in equity allocation rising from 5.25 per cent to 8 per cent.

Even the petroleum products as a sector saw a rise in equity allocation from 5.14 per cent in February to 7.68 per cent in September.

“Covid is not settled yet and the vaccine is still not in sight and in such a scenario the fund managers are wary about how the post-moratorium scenario may impact banks’ assets. There are concerns that there may be delinquencies even in the retail books going forward,” said CJ George, MD, Geojit Financial Services.

“Also, since IT as a sector has been doing quite well globally, it has been one of the beneficiaries of allocation by mutual funds,” said George.

With health emerging as a main concern during the pandemic, pharmaceuticals, as a sector, has done well.

The dip in share of banks is also because of the relatively weaker recovery of banking stocks over the last five months.

While the benchmark Sensex at BSE was down only 0.6 per cent in September over its February closing of 38,297, the banking index at BSE was trailing its February closing by 27 per cent in September.

By comparison, while the IT index at BSE was up 33 per cent at the end of September over February closing, the healthcare index was up by 47 per cent. Even Auto and FMCG indices were up 14.8 per cent and 0.8 per cent in September over their February closing.

Given that banking sector is a market laggard, some experts see an opportunity.

The CEO of a large fund house said that while there are concerns around rise in non-performing assets over the next few months, smart investors are now taking a position in banking stocks. “If you pick a good bank which has good quality assets, it will generate strong return over the next two to three years,” he said.

On Monday, bank stocks witnessed a sharp jump with the banking index rising by 3.3 per cent. While ICICI Bank jumped 5.3 per cent, SBI and Axis Bank rose 4.2 per cent and 4.4 per cent.

? The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Business News, download Indian Express App.

Read More: Covid shadow: Sharp dip in banks’ share in equity funds, tech & pharma surge