Binance Research Report Unveils Transformative Growth in DeFi Markets

Binance Research has published its latest comprehensive report, “Breakthrough DeFi Markets,” revealing remarkable growth and transformative innovations within the decentralized finance (DeFi) sector in 2024. The report highlights a significant influx of capital, substantial market expansions, and emerging trends that are set to redefine the DeFi landscape

Explosive Growth in Total Value Locked

The total value locked (TVL) in DeFi has soared by 75.1% year-to-date (YTD), reaching a staggering $94.9 billion. This robust growth underscores a significant influx of capital and increasing investor confidence in the DeFi ecosystem. Investors and stakeholders are increasingly recognizing the potential and resilience of DeFi platforms, leading to widespread adoption and expansion across various financial services.

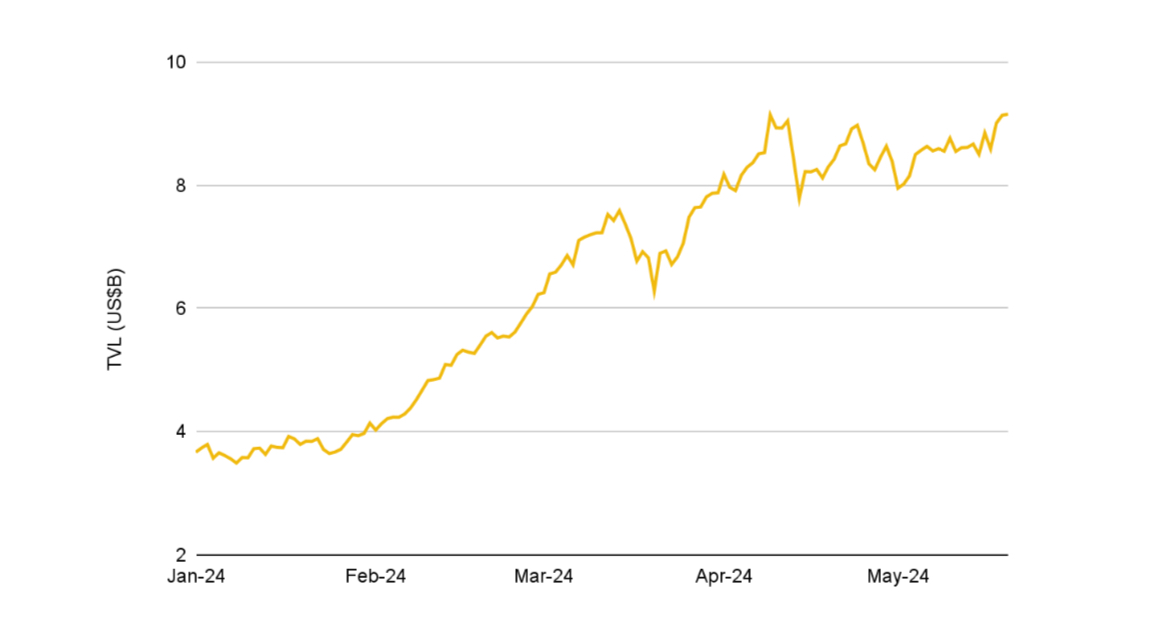

Yield Market Expansion

A standout in this growth has been the yield market, which expanded by an impressive 148.6% to $9.1 billion in TVL. Pendle, a yield trading protocol, has been at the forefront of this expansion. Pendle’s TVL has skyrocketed by 1962% YTD, reaching $4.8 billion, driven by the rise of yield-bearing assets and increased rate volatility. By tokenizing yield-bearing assets into standardized yield tokens, Pendle has democratized access to interest rate derivatives. This allows users to speculate, hedge, and execute advanced strategies on yield-bearing assets, significantly enhancing market participation and liquidity.

Pendle’s innovative approach enables users to earn fixed yields, leverage the yield of an underlying asset, or employ a mix of strategies. Its success is a testament to the growing appetite for sophisticated financial instruments in the DeFi space, reflecting the sector’s maturation and the increasing complexity of its offerings.

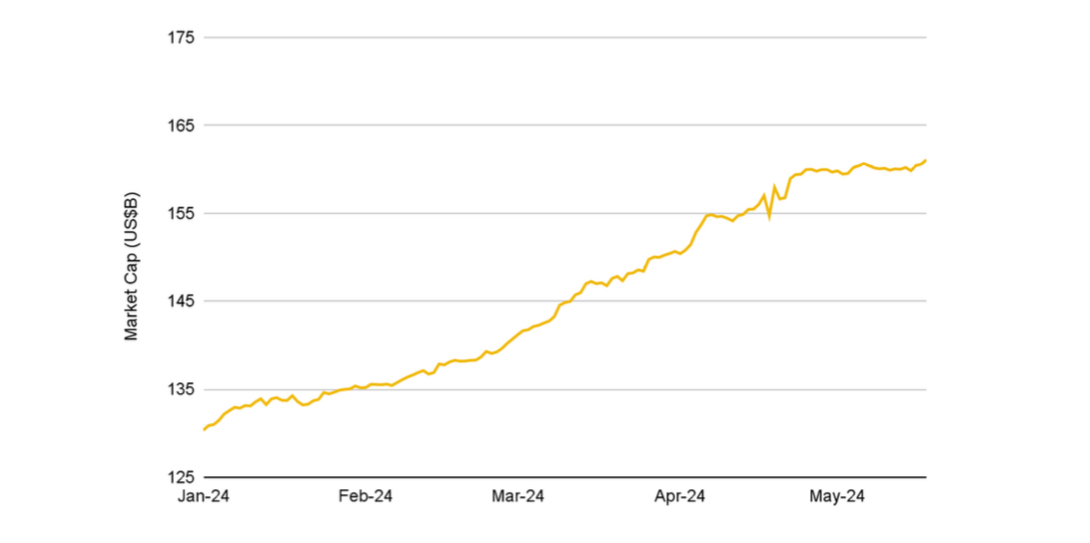

Stablecoin Market Surge

Simultaneously, the stablecoin market has seen substantial expansion, with the market capitalization of stablecoins surging to $161.1 billion, the highest in nearly two years. Ethena, with its innovative stablecoin USDe, has played a pivotal role in this growth. Ethena’s USDe has experienced a remarkable 2730.4% increase in market cap, reaching $2.4 billion. The secret to Ethena’s success lies in its unique delta-neutral strategy, which combines staked ETH and perpetual futures funding rates, offering attractive yields and substantial market penetration.

Ethena’s approach addresses the long-standing demand for yield-bearing stablecoins that are both capital efficient and capable of integrating seamlessly with the broader DeFi ecosystem. By leveraging the yield from staked ETH and the positive funding rates of perpetual futures, Ethena has created a stablecoin that not only maintains its peg but also generates significant returns for its holders. This model represents a significant advancement in the stablecoin space, providing a viable alternative to traditional, centralized stablecoins and offering users greater flexibility and earning potential.

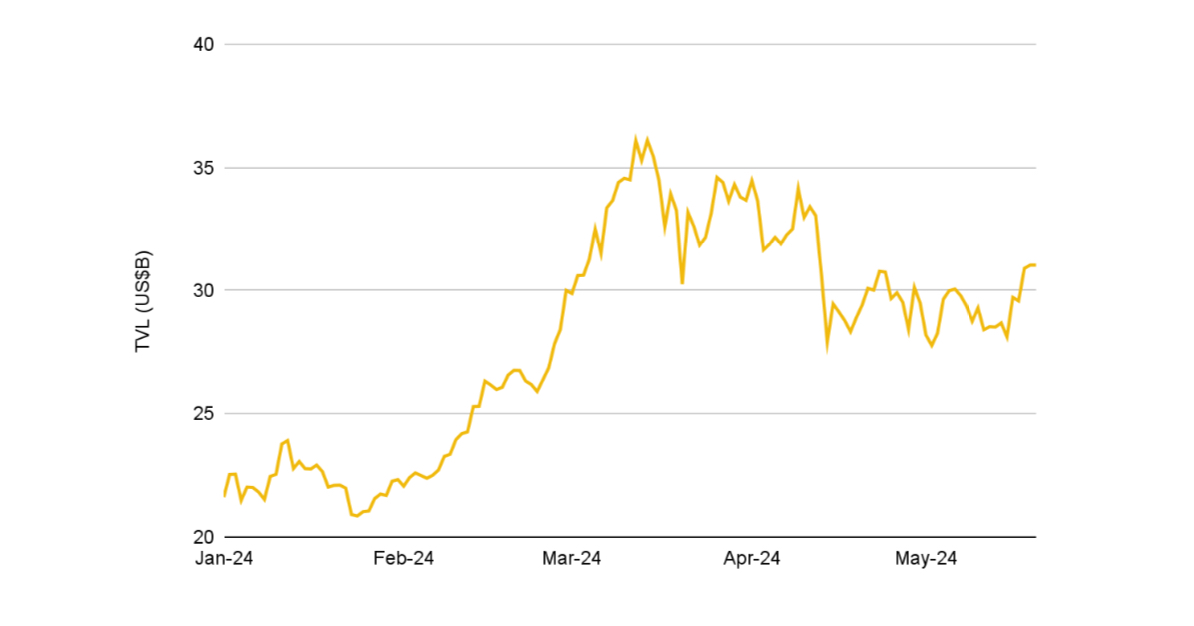

Evolution of Money Markets

On-chain money markets have also evolved significantly, with TVL in money markets growing by 47.2%, totaling $32.7 billion. This growth has been fueled by the demand for more flexible lending products. Morpho, a modular lending protocol, has been at the forefront of this evolution. Since the introduction of Morpho Blue and MetaMorpho in January 2024, Morpho has attracted over $1.2 billion in deposits. These protocols showcase the potential of modular lending, offering a new level of flexibility and efficiency in the lending market.

Morpho Blue enables the creation of isolated lending markets with customized risk parameters, providing users with greater control over their lending and borrowing activities. MetaMorpho builds on this by allowing for permissionless risk curation and the creation of lending vaults that aggregate liquidity across multiple markets. This modular approach addresses the limitations of traditional multi-asset lending pools, such as liquidity fragmentation and inefficiency, by offering a more tailored and efficient solution.

Morpho’s innovative design has attracted significant attention and capital, highlighting the increasing demand for more flexible and efficient lending solutions in the DeFi space. As the market continues to evolve, Morpho’s approach is likely to set a new standard for on-chain lending protocols, driving further innovation and growth in the sector.

Resurgence of…

Read More: Binance Research Report Unveils Transformative Growth in DeFi Markets