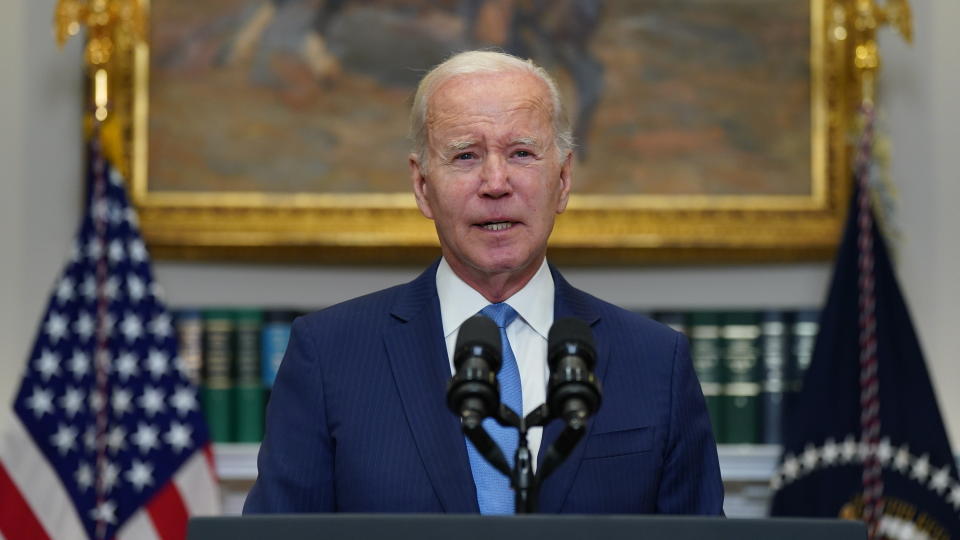

4 Social Security Shakeups from Biden That Could Hit Your Wallet by 2024

As the Social Security Old Age and Survivors Insurance Trust (OASI) faces depletion by 2033, President Joe Biden has suggested what MSN calls a “sweeping four-point plan” to bolster funds in the trust and help fill the $22.4 trillion funding shortage shown in the 2023 Trustees Report. If the federal government can’t fix the shortage, it could result in benefit cuts of up to 24% for retirees beginning in 2033.

Social Security: Proposal for $2,400 Extra in Checks Expanded and Reintroduced in Congress

Learn: Demand for Gold Is Up – Here’s Everything You Need To Know

While some of Biden’s proposed changes will affect mostly high earners and company executives — those who have retirement savings plans exponentially higher than the average American — some will affect middle- and lower-income wage earners, especially those who may rely on social security benefits in the future.

Implement Payroll Tax for Income Over $400,000

Currently, any earned income below $160,200 is subject to a 12.4% payroll tax. Earnings exceeding that amount are not subject to OASI taxes. Biden plans to tax earned income above $400,000, leaving wages above $160,200 up to $400,000 untaxed.

Change the Way COLA Increases Are Calculated

Each year, Social Security benefits are assessed based on inflation and adjusted through Cost of Living Allowance (COLA). Currently, the administration uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to calculate COLA. But this number doesn’t necessarily reflect the lifestyle and expenses of retired people. Shifting COLA calculations to figures tied to the Consumer Price Index for the Elderly won’t solve the problem of Social Security running out of money. But it could put more money into the pockets of retired Americans who need it most.

Increase the Primary Insurance Amount

The Primary Insurance Amount (PIA) is a figure indicating how much money you’ll receive in Social Security benefits, depending on the age you begin claiming benefits and your Average Indexed Monthly Earnings (AIME). Increasing the PIA for Americans aged 78 to 82 would help those who experience rising expenses, such as healthcare, later in life.

Increase the Special Minimum Benefit for Lifetime Lower-Wage Workers

Low-wage earners receive a special minimum benefit regardless of how much they made while they worked. In 2023, a lifetime low-earning worker would receive just $12,402 in Social Security benefits annually, or $1,033.50 per month. Biden intends to increase the minimum benefit to 125% of the federal poverty level for an individual. As an example, in 2023, someone receiving the special minimum benefit would receive $1,518.75 per month with the boost.

Take Our Poll: Who Has Given You the Best Money Advice You Have Ever Received?

Social Security: No Matter Your Age, Do Not Claim Benefits Until You Reach This Milestone

Unfortunately, the plan is unlikely to pass Congress, MSN reported. Any Social Security overhaul plan would require bi-partisan support in Washington and, so far, Democrats and Republicans haven’t been able to see eye-to-eye on ways to simultaneously bolster Social Security coffers and increase benefits for those who need them most.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 4 Social Security Shakeups from Biden That Could Hit Your Wallet by 2024

Read More: 4 Social Security Shakeups from Biden That Could Hit Your Wallet by 2024